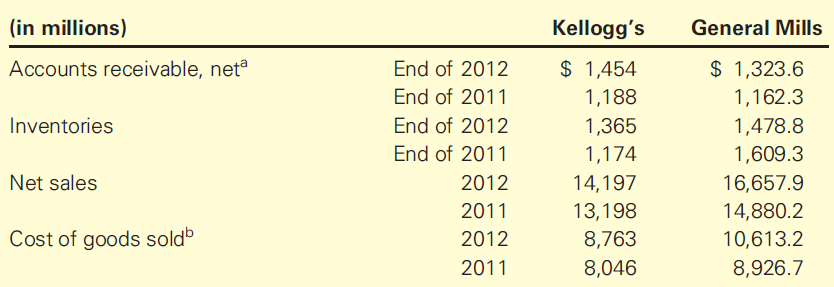

The following information was obtained from the fiscal year 2012 and 2011 financial statements included in Form

Question:

aDescribed as €˜€˜receivables€™€™ by General Mills.

bDescribed as €˜€˜cost of sales€™€™ by General Mills.

Required

1. Using the information provided, compute the following for each company for 2012:

a. Accounts receivable turnover ratio

b. Number of days€™ sales in receivables

c. Inventory turnover ratio

d. Number of days€™ sales in inventory

e. Cash-to-cash operating cycle

2. Comment briefly on the liquidity of each of these two companies.

Inventory Turnover RatioThe inventory turnover ratio is a ratio of cost of goods sold to its average inventory. It is measured in times with respect to the cost of goods sold in a year normally. Inventory Turnover Ratio FormulaWhere,... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting The Impact on Decision Makers

ISBN: 978-1285182964

9th edition

Authors: Gary A. Porter, Curtis L. Norton

Question Posted: