Question:

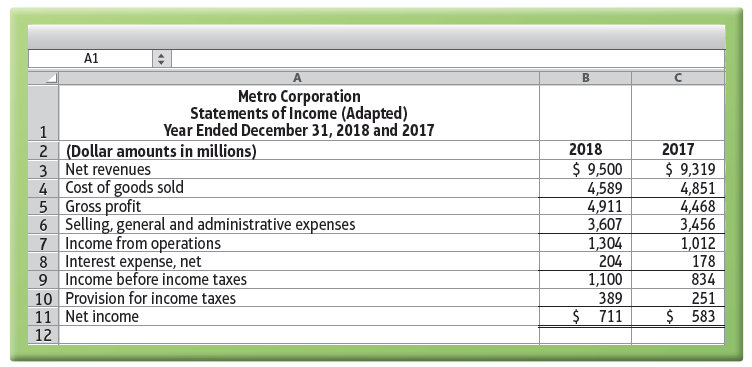

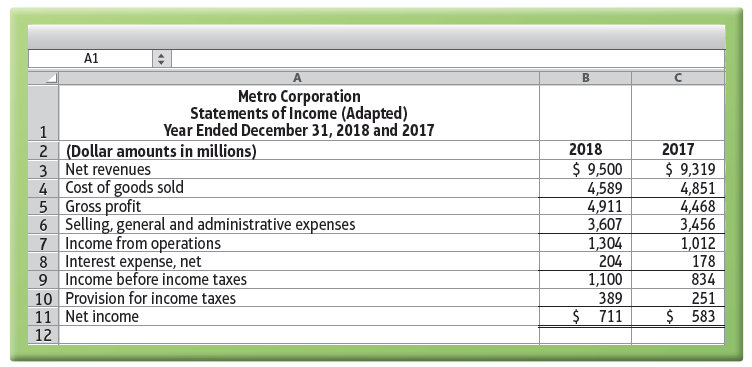

The Metro 2018 income statement follows.

Use the preceding income statement and the balance sheet from S12-6 to calculate the following:

a. Metro’s rate of inventory turnover and days’ inventory outstanding for 2018.

b. Days’ sales in average receivables (days’ sales outstanding) during 2018 (round dollar amounts to one decimal place). Assume all sales are made on account.

c. Accounts payable turnover and days’ payables outstanding for 2018. For this purpose, assume that the impact of inventories on cost of goods sold is immaterial, allowing you to use cost of goods sold rather than purchases in your computations.

d. Length of cash conversion cycle in days for 2018.

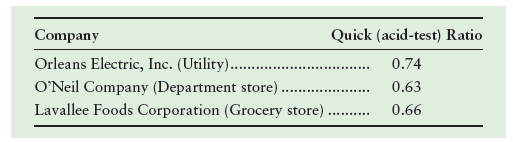

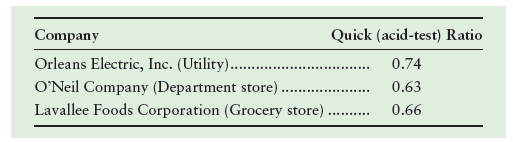

Do these measures look strong or weak? Give the reason for your answer.

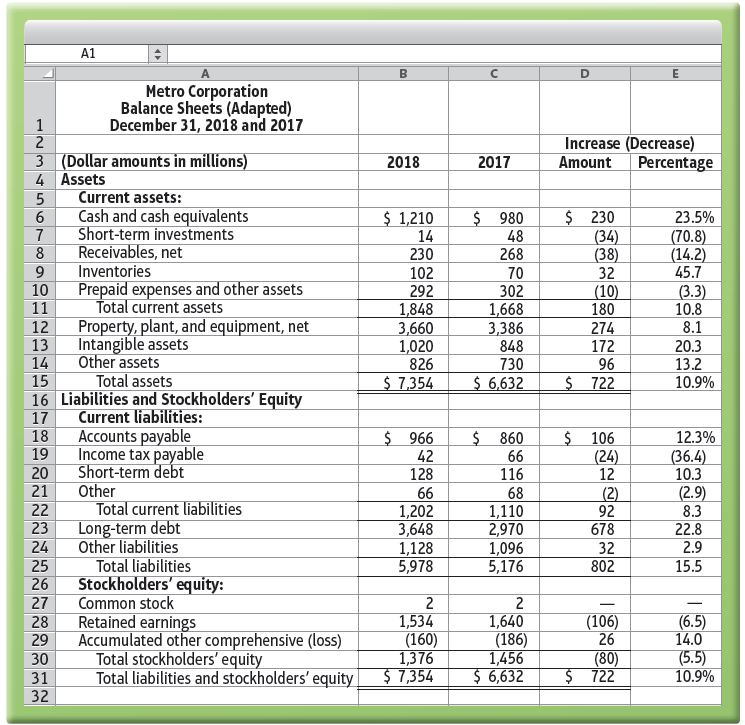

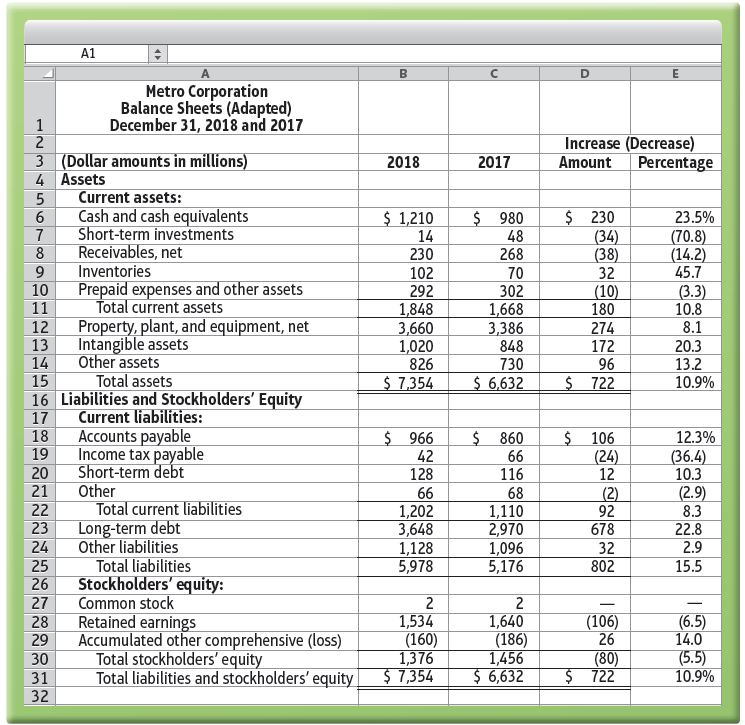

Data from S12-6

To follow are the balance sheets for Metro Corporation and selected comparative competitor data.

Cash Conversion Cycle

Cash conversion cycle measures the total time a business takes to convert its cash on hand to produce, pay its suppliers, sell to its customers and collect cash from its customers. The process starts with purchasing of raw materials from suppliers,...

Transcribed Image Text:

A1 Metro Corporation Statements of Income (Adapted) Year Ended December 31, 2018 and 2017 1 2018 $ 9,500 4,589 4,911 3,607 1,304 204 1,100 389 $ 711 2017 2 (Dollar amounts in millions) 3 Net revenues 4 Cost of goods sold 5 Gross profit 6 Selling, general and administrative expenses 7 Income from operations 8 Interest expense, net 9 Income before income taxes 10 Provision for income taxes 11 Net income $ 9,319 4,851 4,468 3,456 1,012 178 834 251 $ 583 12 A1 Metro Corporation Balance Sheets (Adapted) December 31, 2018 and 2017 Increase (Decrease) Amount 3 (Dollar amounts in millions) 4 Assets 2018 2017 Percentage Current assets: Cash and cash equivalents Short-term investments $ 1,210 14 230 $ 980 48 268 $ 230 (34) (38) 32 23.5% Receivables, net Inventories Prepaid expenses and other assets (70.8) (14.2) 45.7 8 102 70 10 292 1,848 3,660 1,020 826 302 1,668 3,386 848 730 (3.3) 10.8 8.1 Total current assets (10) 180 11 12 Property, plant, and equipment, net 274 172 Intangible assets Other assets 13 14 15 16 Liabilities and Stockholders' Equity 20.3 13.2 10.9% Total assets $ 7,354 $ 6,632 96 $ 722 17 Current liabilities: Accounts payable $ 860 66 18 $ 966 42 128 $ 106 (24) 12 12.3% (36.4) 10.3 19 Income tax payable 20 Short-term debt Other 21 22 Total current liabilities 66 1,202 3,648 1,128 5,978 116 68 1,110 2,970 1,096 5,176 (2) 92 678 32 (2.9) 8.3 22.8 2.9 23 Long-term debt 24 Other liabilities Total liabilities Stockholders' equity: Common stock Retained earnings 25 802 15.5 26 2 1,534 (160) 1,376 $ 7,354 27 2 1,640 (186) 1,456 $ 6,632 (106) 26 (80) $ 722 (6.5) 14.0 (5.5) 10.9% 28 29 Accumulated other comprehensive (loss) Total stockholders' equity Total liabilities and stockholders' equity 30 31 32