The September 30, 2019, records of West Point Communications include these accounts: Accounts Receivable.................................... $249,000 Allowance for

Question:

The September 30, 2019, records of West Point Communications include these accounts:

Accounts Receivable.................................... $249,000

Allowance for Doubtful Accounts ............... (8,000

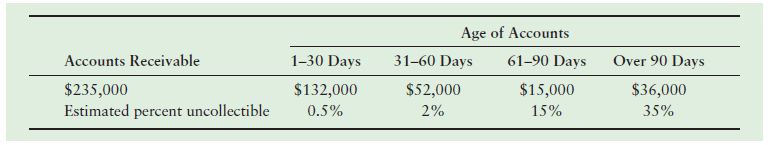

During the year, West Point Communications estimates Uncollectible-account expense at 1% of credit sales. At year-end (December 31), the company ages its receivables and adjusts the balance in Allowance for Uncollectible Accounts to correspond to the following aging schedule:

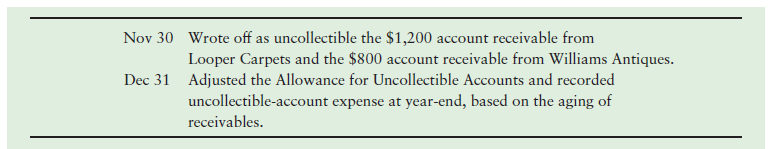

During the last quarter of 2019, the company completed the following selected transactions:

Requirements

1. Record the transactions for the last quarter of 2019 in the journal. Explanations are not required.

2. Prepare a T-account for Allowance for Uncollectible Accounts with the appropriate beginning balance. Post the entries from requirement 1 to that account.

3. Show how West Point Communications will report its accounts receivable in a comparative balance sheet for 2018 and 2019. (Use the three-line reporting format.) At December 31, 2018, the company’s Accounts Receivable balance was $212,000 and the Allowance for Uncollectible Accounts stood at $4,800.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.