Use the data for Spear Corporation in E6-30B to illustrate Spears income tax advantage from using LIFO

Question:

Use the data for Spear Corporation in E6-30B to illustrate Spear’s income tax advantage from using LIFO over FIFO. Sales revenue is $10,080, operating expenses are $800, and the income tax rate is 25%. How much in taxes would Spear Corporation save by using the LIFO method versus FIFO?

Data from E6-30B

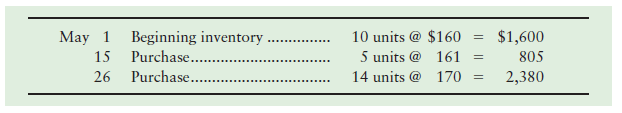

Spear Corporation’s inventory records for its retail division show the following at May 31:

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted: