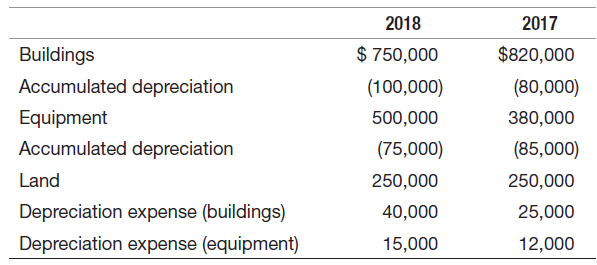

Webb Industries reported the following information concerning the companys property, plant, and equipment in its 2018 financial

Question:

Listed here are four independent cases involving buildings, equipment, and land during 2018.

Listed here are four independent cases involving buildings, equipment, and land during 2018.1. The company purchased a building for $60,000.

2. The company sold equipment in December 2018 that was purchased for $50,000. It recorded a gain of $5,000 on the sale.

3. The company sold a piece of land for $300,000 at a gain of $75,000.

4. The company acquired a building in exchange for land. The land had a book value of $150,000 and a market value of $600,000.

REQUIRED:

a. For each case, explain the change from 2017 to 2018 in the affected buildings, equipment, and land accounts. (For example, in case [1] explain the change in the building account, the related accumulated depreciation account, and the balance in the related depreciation expense account.)

b. For each case, compute the effect on the cash balance, and indicate the appropriate disclosure on the statement of cash flows.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: