You are a financial analyst currently reviewing the financial statements of Danner International and Brady Enterprises, two

Question:

Brady€™s effective tax rate is 35 percent.

REQUIRED:

a. Restate Brady€™s net income assuming there was no LIFO liquidation in 2017. How does the restated amount compare to Danner€™s net income?

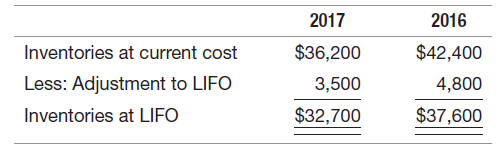

b. Restate Brady€™s 2017 reported net income as if the company had always been a FIFO user. Is Brady€™s restated reported income higher or lower than Danner€™s reported net income? Explain.

c. As of the end of 2017, how much accumulated income tax had Brady saved due to its choice of LIFO instead of FIFO? How much as of the end of 2016? Does LIFO save taxes in every year? Explain.

d. Would it be advisable for Brady to change its cost fl ow assumption from LIFO to FIFO? Discuss.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due....

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: