You have just been hired as a stock analyst for a large stock brokerage company. Your first

Question:

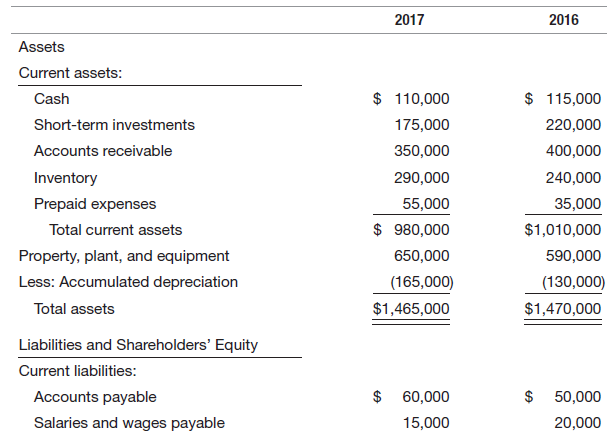

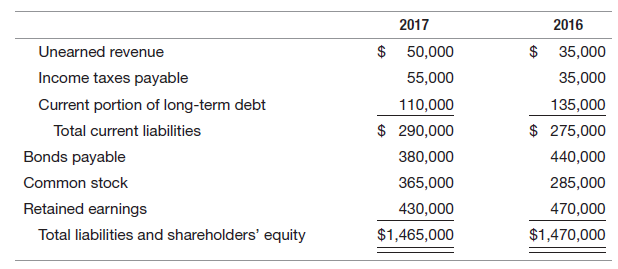

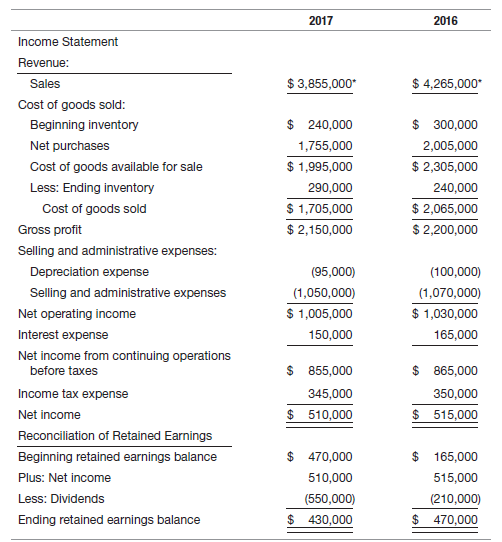

The company€™s income statement and reconciliation of retained earnings for the years ended December 31, 2016 and 2017, are presented below.

* $1,255,000 of 2016 sales were in cash and the remainder on credit. $1,405,000 of 2017 sales were in cash and the remainder on credit.

The market prices of the company€™s stock as of January 1, 2016, December 31, 2016, and December 31, 2017, were $65, $69, and $54 per share, respectively. The January 1, 2016, balance in shareholders€™ equity was $450,000, there were no changes in the number of common shares outstanding or in accounts receivable during 2016, and the income tax rate was 40 percent for 2016 and 2017. Total assets as of January 1, 2016, were $1,450,000. Assume the number of shares outstanding was 17,000 at year end 2015 and 2016 and 22,000 at year-end 2017.

REQUIRED:

Answer the following questions (including any relevant ratios in your answers) for both 2016 and 2017. Unless the December 31, 2015, balance is provided, assume that the December 31, 2016, balance reflects the average balance during 2016.

1. How effective is the company at managing investments made by the equity owners?

2. Is the company using debt in the best interests of the equity owners?

3. Can the company meet its current obligations using current assets? Using cash-like assets?

4. How sensitive are stock prices to changes in earnings?

5. How many days is the average account receivable outstanding? Are the days outstanding increasing or decreasing?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: