Andres is taxed at a 17% tax rate for his federal taxes. Last year, he reduced his

Question:

Andres is taxed at a 17% tax rate for his federal taxes. Last year, he reduced his taxable income by contributing $350 per biweekly paycheck to his tax-deferred retirement account and $50 per biweekly paycheck to his FSA. How much did he reduce his annual federal taxes by if his gross biweekly pay is $1,870?

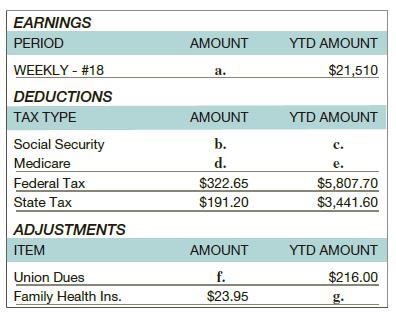

Transcribed Image Text:

EARNINGS PERIOD WEEKLY - #18 DEDUCTIONS TAX TYPE Social Security Medicare Federal Tax State Tax ADJUSTMENTS ITEM Union Dues Family Health Ins. AMOUNT a. AMOUNT b. d. $322.65 $191.20 AMOUNT f. $23.95 YTD AMOUNT $21,510 YTD AMOUNT C. e. $5,807.70 $3,441.60 YTD AMOUNT $216.00

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

Amount he reduce his annua...View the full answer

Answered By

Willis Omondi

Hi, I'm Willis Omondi, a proficient and professional academic writer. I have been providing high-quality content that best suits my clients and completing their work within the deadline. All my work has been 100% plagiarism-free, according to research from my services, especially in arts subjects and many others

0.00

0 Reviews

10+ Question Solved

Related Book For

Financial Algebra Advanced Algebra With Financial Applications

ISBN: 9781337271790

2nd Edition

Authors: Robert Gerver, Richard J. Sgroi

Question Posted:

Students also viewed these Mathematics questions

-

Because income from fixed income assets is taxed at a higher income tax rate than capital gains and dividends from equities, there is no reason that one would have fixed income assets in a taxable...

-

Martina is taxed at a rate of 25% for her federal taxes. Last year, she reduced her taxable income by contributing to a flexible savings plan in the amount of $2,700. If her wages before the...

-

How much federal income tax should Aman report if she earned taxable income of $32 920 and $17 700 from her two jobs? Use the 2012 federal income tax brackets and rates in Table 3.3 to answer the...

-

Listed below is the income statement for Tom and Sue Travels, Incorporated. TOM AND SUE TRAVELS, INCORPORATED Income Statement for Year End ( in millions of dollars ) Net sales $ 1 9 . 6 0 0 Less:...

-

The Northwest Pacific Phone Company wishes to estimate the average number of minutes its customers spend on long-distance calls per month. The company wants the estimate made with 99% confidence and...

-

The financial statements of ConAgra Foods, Inc.?s 2017 annual report disclose the following information. Instructions Compute ConAgra?s (a) Inventory turnover (b) The average days to sell inventory...

-

It looks to me that you have devoted everything to this company and they have treated you badly. Is that right?

-

At December 31, 2011, certain accounts included in the property, plant, and equipment section of Reagan Companys balance sheet had the following balances. Land$230,000 Buildings 890,000 Leasehold...

-

18) A physician prescribes one 0.7 mg tablet of a medication to be taken twice a day for 15 days. How many total mcg of the medication will the patient have taken after 15 days?

-

Discuss each of the following terms: a. Data b. Field c. Record d. File

-

Use Tax Schedule Y-1 from Example 1 and Exercises 5 and 6. Select any income. Write an equation for that income for the three different years. Data From Exercise 6 Use the 2012 Schedule Y-1 for a...

-

For what taxable income would a taxpayer have to pay $26,277.50 in taxes? Explain your reasoning. Schedule Z-If your filing status is Head of household If your taxable income is: Over- $0 13,150...

-

To test H0: p = 0.30 versus H1: p 0.30, a simple random sample of n = 300 individuals is obtained and x = 86 successes are observed. (a) What does it mean to make a Type II error for this test? (b)...

-

Post-conditions are (a) implementation constraints on the design of the use case (b) conditions that must test true after executing the use case but are outside the responsibility of the use case to...

-

Explain how the events listed in (a) through (d) would affect the following costs of a firm producing cups: 1. Marginal cost 2. Average variable cost 3. Average fixed cost 4. Average total cost a....

-

Name some financial intermediaries. How do they make profits?

-

Use the data in Appendix 11 to rationalize the following observations in a quantitative manner. What assumption(s) have you made in answering this question? (a) The dithionate ion, [S 2 O 6 ] 2 , can...

-

An article in the Wall Street Journal refers to people who graduated from college and entered the labor force in 2009 as Generation Jobless. Briefly explain what the article means.

-

As a consultant to an investment company trading in various currencies, you have been assigned the task of studying long-term trends in the exchange rates of the Canadian dollar, the Japanese yen,...

-

$10,000 was borrowed at 3.5% on July 17. The borrower repaid $5000 on August 12, and $2000 on September 18. What final payment is required on November 12 to fully repay the loan?

-

Select the third point from each of the six samples, and compute the sample sd from the collection of six third points? Table 6.2: Sample of birth-weights (oz) obtained from 1000 consecutive...

-

What theoretical relationship should there be between the standard deviation in Problem 6.48 and the standard deviation in Problem 6.49? Table 6.2: Sample of birth-weights (oz) obtained from 1000...

-

How do the actual sample results in Problems 6.48 and 6.49 compare? Obstetrics Figure 6.4b (p. 172) plotted the sampling distribution of the mean from 200 samples of size 5 from the population of...

-

At 4pm on a winter day, an arctic-air mass moved from Kansas into Oklahoma, causing temperatures to plumme Oklahoma. The temperatures on that day are recorded in the following table. h T(h) 0 61 1 55...

-

Solve 8 +6x + 10 = 32 for x

-

4. Givens and t, relations on Z, s = {(1, n) : n Z} and t = {(n, 1) n Z}, what are st and ts? Hint: Even when a relation involves infinite sets, you can often get insights into them by drawing...

Study smarter with the SolutionInn App