Anns W-2 form reported total Medicare wages as $88,340. She contributed $50 per weekly paycheck to her

Question:

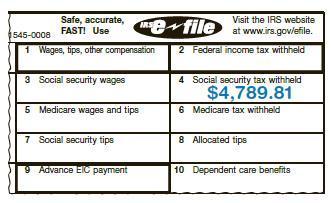

Ann’s W-2 form reported total Medicare wages as $88,340. She contributed $50 per weekly paycheck to her FSA and $90 per weekly paycheck to her retirement plan. She received a 1099 form from her bank for her savings account interest in the amount of $800 and a 1099 form from a book publisher for royalties in the amount of $3,700. What is Ann’s adjusted gross income?

Transcribed Image Text:

1545-0008 Safe, accurate, FAST! Use 1 Wages, tips, other compensation 3 Social security wages 5 Medicare wages and tips 7 Social security tips Visit the IRS website e file at www.irs.gov/efile 2 Federal income tax withheld 9 Advance EIC payment 4 Social security tax withheld $4,789.81 6 Medicare tax withheld 8 Allocated tips 10 Dependent care benefits

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

Anns adjusted gross income 88340 50 90 58130 Since there is no withho...View the full answer

Answered By

Brian Otieno

I'm Brian , an experienced professional freelancer with countless hours of success in freelancing many subjects in different disciplines. Specifically, I have handled many subjects and excelled in many disciplines. I have worked on many Computer Science projects and have been able to achieve a lot in that field. Additionally, I have handled other disciplines like History, Humanities, Social Sciences, Political science, Health care and life science, and Religion / Theology. My experience generally in these subjects has made me able to deliver high-quality projects in a very timely fashion. I am very reliable at my job and will get the work done in time, no matter what. In Addition, I have managed to ensure that the work meets my client's expectations and does not cause an error. I am a hard-working and diligent person who is highly responsible for everything I do. Generally, Freelancing has made me more accountable for doing my job. Additionally, I have had a passion for writing for the last seven years in this field.

0.00

0 Reviews

10+ Question Solved

Related Book For

Financial Algebra Advanced Algebra With Financial Applications

ISBN: 9781337271790

2nd Edition

Authors: Robert Gerver, Richard J. Sgroi

Question Posted:

Students also viewed these Mathematics questions

-

Laurels W-2 form reported total Medicare wages as $100,750. She contributed $30 per weekly paycheck to her FSA and $75 per weekly paycheck to her retirement plan. She received a 1099 form from her...

-

What are the differences in the amount of borrowing costs that can be capitalized under IFRS and U.S. GAAP?

-

A participating ordinary life policy in the amount of $10,000 is sold to an individual, age 35. The following cost data are given: Annual premium ............... $230 Total dividends for 20 years...

-

Boeing Company was scheduled to deliver several of its 747-400 jumbo jetliners to Northwest Airlines by December 31, 1988. Northwest set that deadline because it needed the $16 million in investment...

-

The Federal Communications Commission released a report (Leslie Cauley, USA Today , Study: A la Carte Cable Would Be Cheaper, February 10, 2006) refuting an earlier report released in 2004 by the...

-

Research Science Inc. provides funding to University Hospital to perform a research study on the benefits of a new drug for insomnia. The agreement requires University Hospital to plan the study,...

-

Some of the prior interviews suggest that the company is so cheap that they wont pay people what they are worth. Have you had similar experiences?

-

Gas absorption or gas scrubbing is a commonly used method for removing environmentally undesirable species from waste gases in chemical manufacturing and combustion processes. The waste gas is...

-

The GRE (Graduate Record Exam) scores for both verbal and quantitative reasoning are approximately normally distributed and scaled to have mean 150 with standard deviation of 8.75. 1) Below what...

-

James A. and Ella R. Polk, ages 70 and 65, respectively, are retired physicians who live at 3319 Taylorcrest Street, Houston, Texas 77079. Their three adult children (Benjamin Polk, Michael Polk, and...

-

What is a balanced scorecard? What is its primary objective?

-

Oscar is single with a taxable income for last year of $74,555. His employer withheld $16,381 in federal taxes. a. Use the tax table from Example 2 earlier in this lesson to determine Oscars tax. b....

-

Given the sample 4 7 5 4 (a) Evaluate the t-statistic for testing H 0 : 0 = 3. (b) Use software to check your value of t. R: t.test(x,mu = 3) after x= c( 4, 7, 5, 4)

-

Explain the following: petroleum reservoir primary recovery secondary recovery tertiary recovery

-

Define the following terms: day-rate contract footage-rate contract turnkey contract horizontal drilling

-

A news alert contains the following statement: Telecoms plc this week raised cash by selling $50m bonds with five-year and ten year maturities. Explain each part of the sentence.

-

Define the following terms: fault trap anticline salt dome porosity permeability

-

What is the difference between a conventional and a nonconventional reservoir?

-

Describe several structural decisions that a low-cost hotel such as a Days Inn would have to make. Describe infrastructural decisions that such a hotel would make. How would the decisions made in...

-

If the jobs displayed in Table 18.24 are processed using the earliestdue-date rule, what would be the lateness of job C? TABLE 18.24 Processing Times and Due Dates for Five Jobs Job C D E...

-

Compute a 95% CI for the variance of the concentrations? Obstetrics, Serology A new assay is developed to obtain the concentration of M. hominis mycoplasma in the serum of pregnant women. The...

-

Assuming the point estimate in Problem 6.36 is the true population parameter, what is the probability that a particular assay, when expressed in the log scale to the base 2, is no more than 1.5 log...

-

Answer Problem 6.38 for 2.5 log units? Obstetrics, Serology A new assay is developed to obtain the concentration of M. hominis mycoplasma in the serum of pregnant women. The developers of this assay...

-

Q8 (15 points) Consider the double integral SS x+ y dA, where R is the region bounded R by the semi-circle y = 4x, the line y + x = 0 and the line y = X Set up the iterated integral by using polar...

-

A 34% decrease resulted in 21 business in the downtown are. What was the number of businesses before the decrease?

-

You have an average of 8 2 out of 1 0 0 prior to the final exam. The final exam counts for 2 0 % . You wish a course grade of 8 3 out of 1 0 0 . What is the minimum you need to score out of 1 0 0 on...

Study smarter with the SolutionInn App