Leslie works for Blanck Corporation. His annual salary is $57,285.50. a. What is Leslies annual Social Security

Question:

Leslie works for Blanck Corporation. His annual salary is $57,285.50.

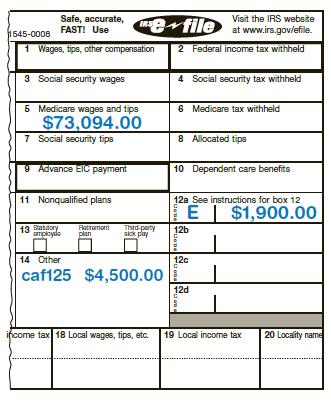

a. What is Leslie’s annual Social Security deduction?

b. What is Leslie’s annual Medicare deduction?

c. Leslie is paid every other week. What is his biweekly gross pay?

d. Each pay period, Leslie’s employer deducts $418.63 for federal income tax.

What percentage of Leslie’s yearly salary is withheld for federal income tax?

e. If Leslie is taxed at an annual rate of 3.65% for city tax, how much is deducted from his salary per paycheck for city tax?

f. Leslie’s net pay for each pay period is $1,347.34. What percent of his biweekly gross pay is deducted from his salary to yield this net pay amount?

g. As of January 1, Leslie will receive a 12.5% raise. What will Leslie’s new annual salary be?

h. If the percentage of his biweekly deductions remains the same, what should Leslie’s new net pay be for each pay period?

Step by Step Answer:

Financial Algebra Advanced Algebra With Financial Applications

ISBN: 9781337271790

2nd Edition

Authors: Robert Gerver, Richard J. Sgroi