Baylor Lumber Products is considering the purchase of a high-efficiency conveyor system. Two manufacturers have approached Baylor

Question:

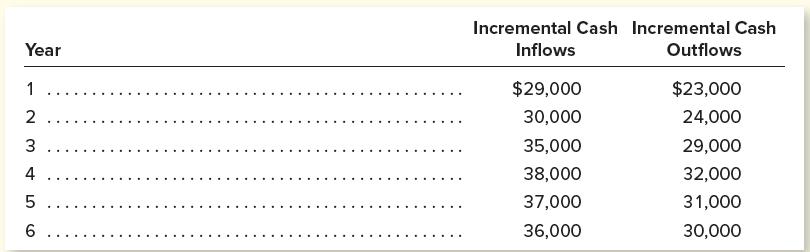

Baylor Lumber Products is considering the purchase of a high-efficiency conveyor system. Two manufacturers have approached Baylor with proposals: (1) Duke Industries and (2) Wake Manufacturing. Regardless of which vendor Baylor chooses, the following incremental cash flows are expected to be realized.

a. If the machine manufactured by Duke Industries costs $30,000, what is its expected payback period?

b. If the machine manufactured by Wake Manufacturing has a payback period of 48 months, what is its cost?

c. Which of the machines is most attractive based on its respective payback period? Should Baylor base its decision entirely on this criterion? Explain your answer.

Step by Step Answer:

Financial And Managerial Accounting The Basis For Business Decisions

ISBN: 9781260247930

19th Edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello