On January 2, 2021, Jatson Corporation acquired a new machine with an estimated useful life of five

Question:

On January 2, 2021, Jatson Corporation acquired a new machine with an estimated useful life of five years. The cost of the equipment was $40,000 with an estimated residual value of $5,000.

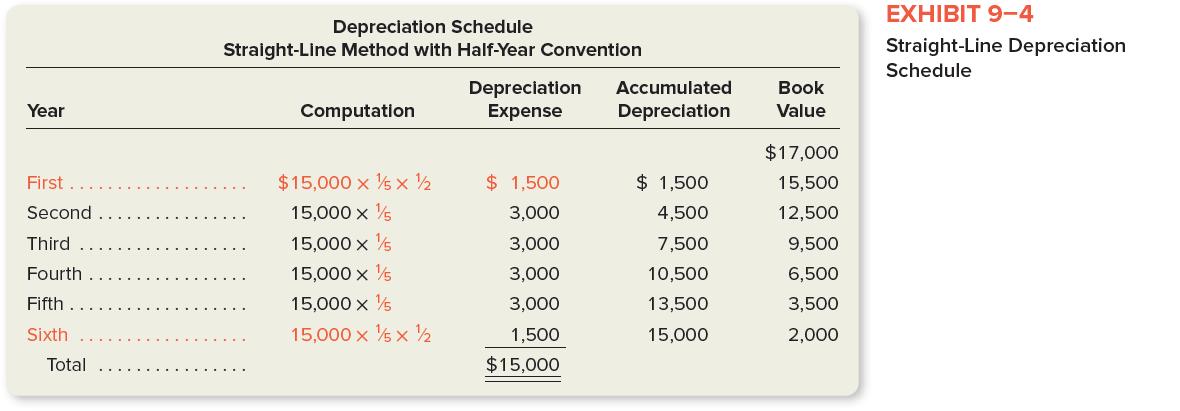

a. Prepare a complete depreciation table under the three depreciation methods listed as follows. Use a format similar to the illustrations in Exhibits 9–4, 9–5, and 9–6. In each case, assume that a full year of depreciation was taken in 2021. 1. Straight-line. 2. 200 percent declining-balance. 3. 150 percent declining-balance with a switch to straight-line when it will maximize depreciation expense.

b. Comment on significant differences or similarities that you observe among the patterns of depreciation expense recognized under each of these methods.

Step by Step Answer:

Financial And Managerial Accounting The Basis For Business Decisions

ISBN: 9781260247930

19th Edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello