The following items were taken from the accounting records of Murfreesboro Telephone Corporation (MTC) for the year

Question:

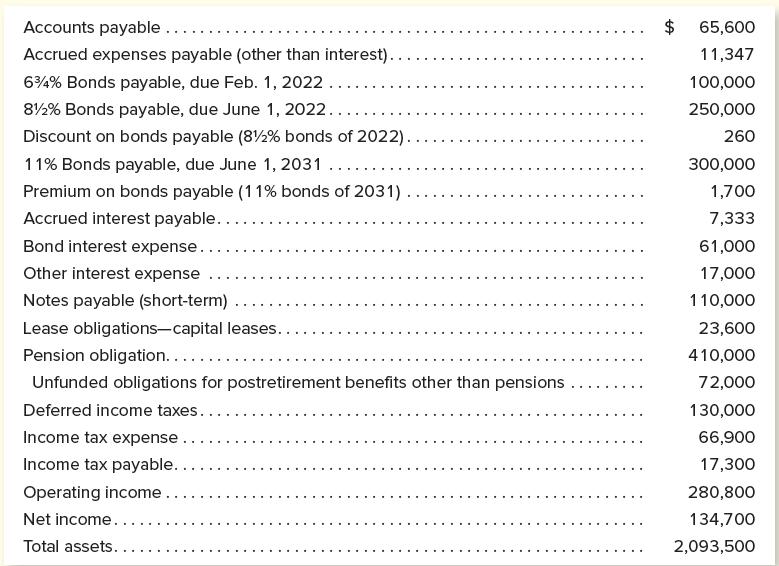

The following items were taken from the accounting records of Murfreesboro Telephone Corporation (MTC) for the year ended December 31, 2021 (dollar amounts are in thousands).

Other Information

1. The 6 3 ⁄ 4 percent bonds due in February 2022 will be refinanced in January 2022 through the issuance of $150,000 in 9 percent, 20-year bonds payable.

2. The 8 1 ⁄ 2 percent bonds due June 1, 2022, will be repaid entirely from a bond sinking fund. (Hint: The bond sinking fund is a noncurrent asset which will affect the classification of the bonds payable.)

3. MTC is committed to total lease payments of $14,400 in 2022. Of this amount, $7,479 is applicable to operating/Type B leases, and $6,921 to capital/Type A leases. Payments on capital/ Type A leases will be applied as follows: $2,300 to interest expense and $4,621 to reduction in the capitalized lease payment obligation.

4. MTC’s pension plan is fully funded with an independent trustee.

5. The obligation for postretirement benefits other than pensions consists of a commitment to maintain health insurance for retired workers. During 2022, MTC will fund $18,000 of this obligation.

6. The $17,300 in income tax payable relates to income taxes levied in 2021 and must be paid on or before March 15, 2022. The deferred tax liability is classified as a noncurrent liability.

Instructions

a. Using this information, prepare the current liabilities and long-term liabilities sections of MTC’s classified balance sheet as of December 31, 2021. (Within each classification, items may be listed in any order.)

b. Explain briefly how the information in each of the six numbered paragraphs affected your presentation of the company’s liabilities.

c. Compute as of December 31, 2021, MTC’s (1) debt ratio and (2) interest coverage ratio.

d. Solely on the basis of information stated in this problem, indicate whether this company appears to be an outstanding, medium, or poor long-term credit risk. State specific reasons for your conclusion.

Step by Step Answer:

Financial And Managerial Accounting The Basis For Business Decisions

ISBN: 9781260247930

19th Edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello