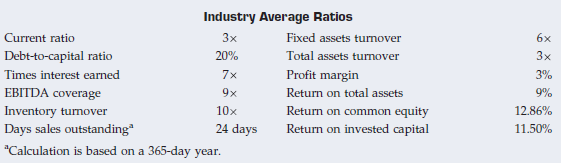

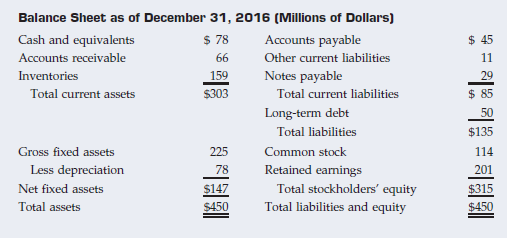

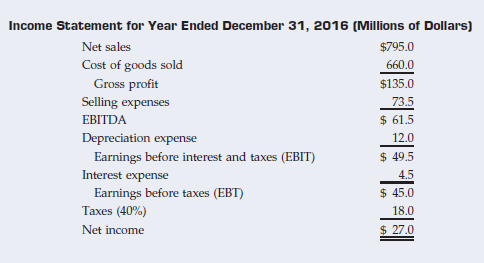

A firm has been experiencing low profitability in recent years. Perform an analysis of the firms financial

Question:

a. Calculate the ratios you think would be useful in this analysis.

b. Construct a DuPont equation, and compare the company€™s ratios to the industry average ratios.

c. Do the balance sheet accounts or the income statement figures seem to be primarily responsible for the low profits?

d. Which specific accounts seem to be most out of line relative to other firms in the industry?

e. If the firm had a pronounced seasonal sales pattern or if it grew rapidly during the year, how might that affect the validity of your ratio analysis? How might you correct for such potential problems?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Financial Management

ISBN: 978-1305635937

Concise 9th Edition

Authors: Eugene F. Brigham

Question Posted: