An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in

Question:

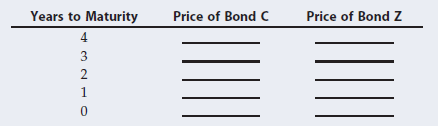

a. Assuming that the yield to maturity of each bond remains at 8.2% over the next 4 years, calculate the price of the bonds at each of the following years to maturity:

b. Plot the time path of prices for each bond.

CouponA coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Financial Management

ISBN: 978-1305635937

Concise 9th Edition

Authors: Eugene F. Brigham

Question Posted: