Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 20Y8, were as

Question:

Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 20Y8, were as follows:

a. Issued 15,000 shares of $20 par common stock at $30, receiving cash.

b. Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash.

c. Issued $500,000 of 10-year, 5% bonds at 104, with interest payable semiannually.

d. Declared a quarterly dividend of $0.50 per share on common stock and $1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding.

e. Paid the cash dividends declared in (d).

f. Purchased 8,000 shares of treasury common stock at $33 per share.

g. Declared a $1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued.

h. Paid the cash dividends to the preferred stockholders.

i. Sold, at $38 per share, 2,600 shares of treasury common stock purchased in (f ).

j. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method.

Instructions

1. Journalize the selected transactions.

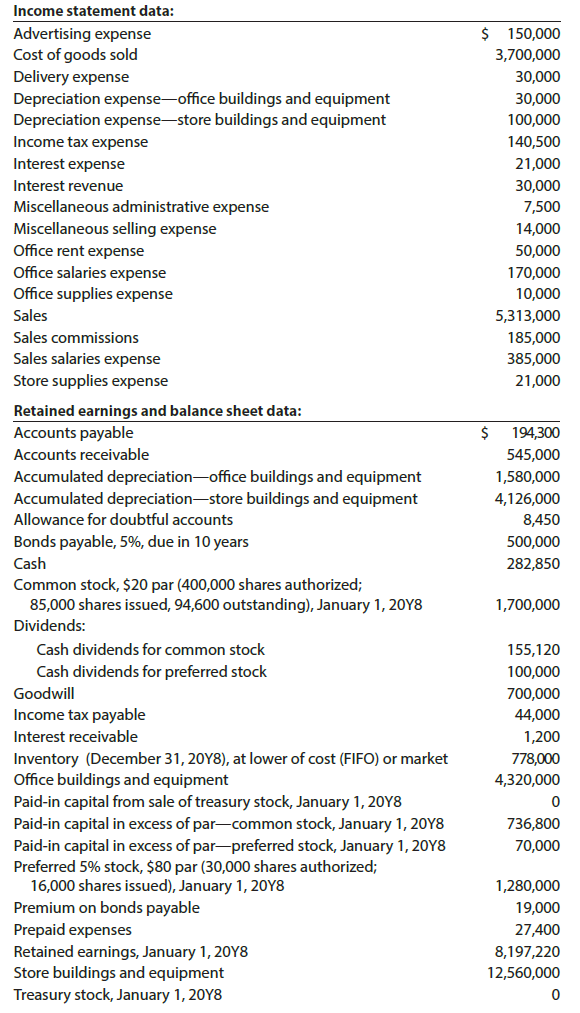

2. The data that follow were taken from the records of Equinox Products Inc. Unless otherwise stated, assume a December 31 balance after adjusting entries.

a. Prepare a multiple-step income statement for the year ended December 31, 20Y8.

b. Prepare a statement of stockholders’ equity for the year ended December 31, 20Y8.

c. Prepare a balance sheet in report form as of December 31, 20Y8.

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 9781337119207

14th Edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac