The following is a list of costs incurred by several manufacturing companies: a. Bonus for vice president

Question:

The following is a list of costs incurred by several manufacturing companies:

a. Bonus for vice president of marketing

b. Costs of operating a research laboratory

c. Cost of unprocessed milk for a dairy

d. Depreciation of factory equipment

e. Entertainment expenses for sales representatives

f. Factory supplies

g. First-aid nurse for factory workers

h. Health insurance premiums paid for factory workers

i. Hourly wages of warehouse laborers

j. Lumber used by furniture manufacturer

k. Maintenance costs for factory equipment

l. Microprocessors for a microcomputer manufacturer

m. Packing supplies for products sold, which are insignificant to the total cost of the product

n. Paper used by commercial printer

o. Paper used in processing various managerial reports

p. Protective glasses for factory machine operators

q. Salaries of quality control personnel

r. Sales commissions

s. Seed for grain farmer

t. Television advertisement

u. Prebuilt transmissions for an automobile manufacturer

v. Wages of a machine operator on the production line

w. Wages of secretary of company controller

x. Wages of telephone operators for a toll-free, customer hotline

Instructions

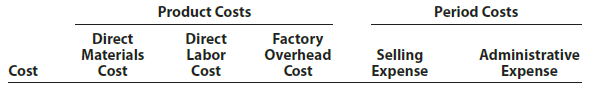

Classify each of the preceding costs as a product cost or period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a factory overhead cost. Indicate whether each period cost is a selling expense or an administrative expense. Use the following tabular headings for preparing your answer. Place an “X” in the appropriate column.

Step by Step Answer:

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton