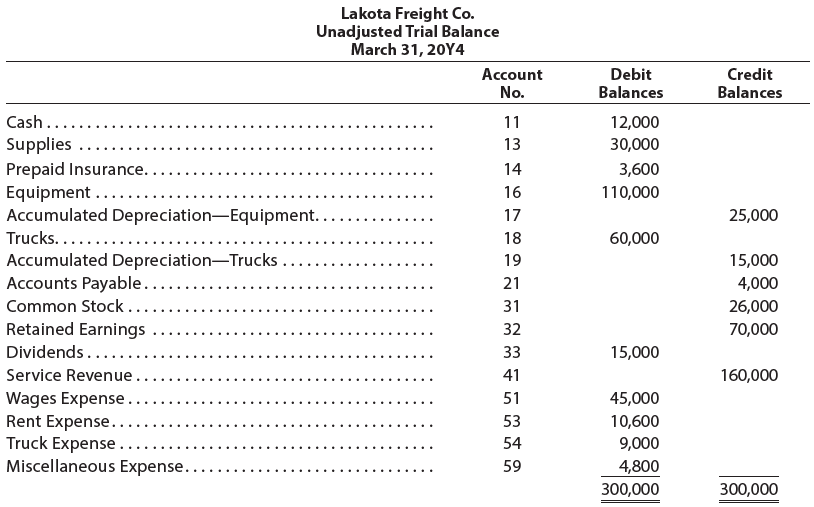

The unadjusted trial balance of Lakota Freight Co. at March 31, 20Y4, the end of the year,

Question:

The unadjusted trial balance of Lakota Freight Co. at March 31, 20Y4, the end of the year, follows:

The data needed to determine year-end adjustments are as follows:

(a) Supplies on hand at March 31 are $7,500.

(b) Insurance premiums expired during year are $1,800.

(c) Depreciation of equipment during year is $8,350.

(d) Depreciation of trucks during year is $6,200.

(e) Wages accrued but not paid at March 31 are $600.

Instructions

1. For each account listed in the trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark (✓) in the Posting Reference column.

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed.

3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Lakota Freight Co.’s chart of accounts should be used: Wages Payable, 22; Supplies Expense, 52; Depreciation Expense—Equipment, 55; Depreciation Expense—Trucks, 56; Insurance Expense, 57.

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a statement of stockholders’ equity, and a balance sheet. During the year ended March 31, 20Y4, additional common stock of $6,000 was issued.

6. Journalize and post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry.

7. Prepare a post-closing trial balance.

Step by Step Answer:

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton