The Vegas Corporation had both common stock and preferred stock outstanding from 2009 through 2011. Information about

Question:

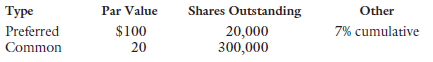

The Vegas Corporation had both common stock and preferred stock outstanding from 2009 through 2011. Information about each stock for the three years is as follows:

The company paid $70,000, $400,000, and $550,000 in dividends for 2009 through 2011, respectively. The market price per common share was $15 and $17 per share at the end of years 2010 and 2011, respectively.

Required

1. Determine the dividends per share and total dividends paid to the common and preferred stockholders each year.

2. Assuming that the preferred stock was noncumulative, repeat the computations performed in requirement 1.

3. Calculate the 2010 and 2011 dividends yield for common stock using dividends per share computed in requirement 2.

4. How are cumulative preferred stock and noncumulative preferred stock similar to long-term bonds? How do they differ from long-term bonds?

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-1439037805

9th edition

Authors: Belverd E. Needles, Marian Powers, Susan V. Crosson