Using the information for Sarot, Inc., in SE 4, SE 5, and SE 7, compute the cash

Question:

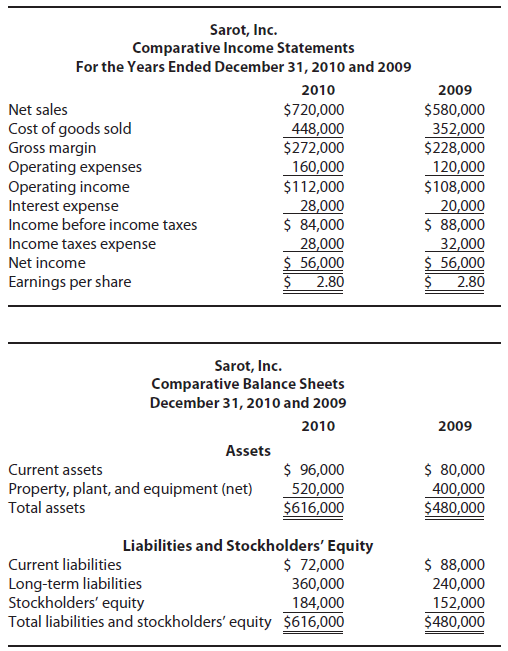

Using the information for Sarot, Inc., in SE 4, SE 5, and SE 7, compute the cash flow yield, cash flows to sales, cash flows to assets, and free cash flow for 2009 and 2010. Net cash flows from operating activities were $84,000 in 2009 and $64,000 in 2010. Net capital expenditures were $120,000 in 2009 and $160,000 in 2010. Cash dividends were $24,000 in both years. Comment on the results. (Round computations to one decimal place.)

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial and Managerial Accounting

ISBN: 978-1439037805

9th edition

Authors: Belverd E. Needles, Marian Powers, Susan V. Crosson

Question Posted: