1. Discuss trends in First Solars revenue streams. For more information about First Solars results, you may...

Question:

1. Discuss trends in First Solar’s revenue streams. For more information about First Solar’s results, you may want to consult the Management Discussion and Analysis in its Form 10-K for 2017, available at the SEC’s website at www.sec.gov.

2. Explain why First Solar recognizes revenue over time for many of its revenue streams.

3. Explain how and why revenue is affected by changes in estimates.

First Solar, Inc., designs and manufactures photovoltaic (PV) solar modules with an advanced thin film semiconductor technology; develops, designs, and constructs PV solar power systems that primarily use the modules it manufactures; and provides operations and maintenance (O&M) services to system owners. In 2017, First Solar adopted ASC Topic 606 (which it refers to in its disclosures as ASU 2014-09) one year before it was required to do so. In adopting the new revenue recognition standard, First Solar used the full retroactive restatement approach.

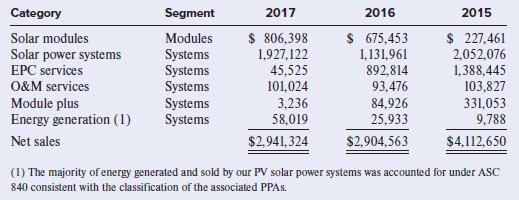

The following is First Solar’s note disclosure related to revenue recognition: 16. Revenue from Contracts with Customers The following table represents a disaggregation of revenue from contracts with customers for the years ended December 31, 2017, 2016, and 2015 along with the reportable segment for each category (in thousands):

We generally recognize revenue for sales of solar power systems and/or EPC services over time using cost based input methods, in which significant judgment is required to evaluate assumptions including the amount of net contract revenues and the total estimated costs to determine our progress towards contract completion and to calculate the corresponding amount of revenue to recognize. If the estimated total costs on any contract are greater than the net contract revenues, we recognize the entire estimated loss in the period the loss becomes known. The cumulative effect of revisions to estimates related to net contract revenues or costs to complete contracts are recorded in the period in which the revisions to estimates are identified and the amounts can be reasonably estimated.

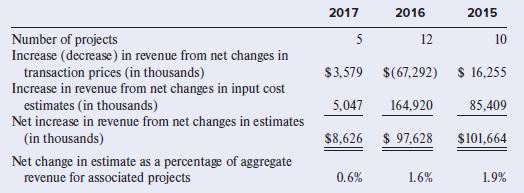

Changes in estimates for sales of systems and EPC services occur for a variety of reasons, including but not limited to (i) construction plan accelerations or delays, (ii) module cost forecast changes, (iii) cost related change orders, or (iv) changes in other information used to estimate costs. Changes in estimates may have a material effect on our consolidated statements of operations. The following table outlines the impact on revenue of net changes in estimated transaction prices and input costs for systems related sales contracts (both increases and decreases) for the years ended December 31, 2017, 2016, and 2015 as well as the number of projects that comprise such changes.

For purposes of the table, we only include projects with changes in estimates that have a net impact on revenue of at least $1.0 million during the periods presented. Also included in the table is the net change in estimate as a percentage of the aggregate revenue for such projects.

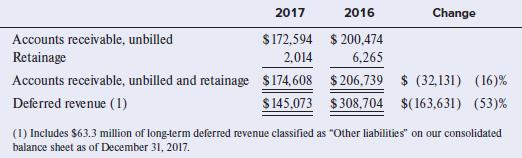

The following table reflects the changes in our contract assets, which we classify as “Accounts receivable, unbilled” or “Retainage,” and our contract liabilities, which we classify as “Deferred revenue,” for the year ended December 31, 2017 (in thousands):

Accounts receivable, unbilled represents a contract asset for revenue that has been recognized in advance of billing the customer, which is common for long-term construction contracts. Billing requirements vary by contract but are generally structured around the completion of certain construction milestones. Some of our EPC contracts for systems we build may also contain retainage provisions. Retainage represents a contract asset for the portion of the contract price earned by us for work performed, but held for payment by the customer as a form of security until we reach certain construction milestones.

When we receive consideration, or such consideration is unconditionally due, from a customer prior to transferring goods or services to the customer under the terms of a sales contract, we record deferred revenue, which represents a contract liability. Such deferred revenue typically results from billings in excess of costs incurred on long-term construction contracts and advance payments received on sales of solar modules.

For the year ended December 31, 2017, our contract assets decreased by $32.1 million primarily due to final billings on the East Pecos project and additional billings on the Butler and Shams Ma’an projects following the completion of substantially all construction activities in 2016, partially offset by unbilled receivables associated with the sale of the California Flats project in 2017. For the year ended December 31, 2017, our contract liabilities decreased by $163.6 million primarily as a result of the completion of the sale of the Moapa project, on which we had received a significant portion of the proceeds in 2016, and revenue recognized from construction on the Helios project following the partial billing of such services in 2016, partially offset by advance payments received on sales of solar modules. During the years ended December 31, 2017 and 2016, we recognized revenue of $308.6 million and $98.3 million, respectively, that was included in the corresponding contract liability balance at the beginning of the periods.

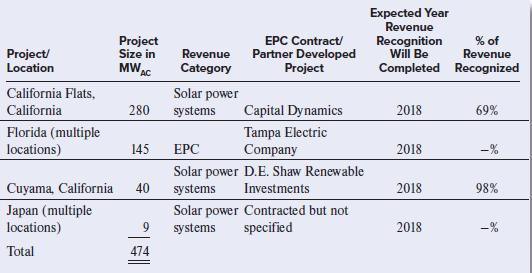

The following table represents our remaining performance obligations as of December 31, 2017 for sales of solar power systems, including uncompleted sold projects, projects under sales contracts subject to conditions precedent, and EPC agreements for partner developed projects that we are constructing or expect to construct. Such table excludes remaining performance obligations for any sales arrangements that had not fully satisfied the criteria to be considered a contract with a customer pursuant to the requirements of ASC 606. We expect to recognize $0.5 billion of revenue for such contracts through the later of the substantial completion or the closing dates of the projects.

As of December 31, 2017, we had entered into contracts with customers for the future sale of 6.5 GWDC of solar modules for an aggregate transaction price of $2.3 billion. We expect to recognize such amounts as revenue through 2020 as we transfer control of the modules to customers, which typically occurs upon shipment or delivery depending on the terms of the underlying contracts. As of December 31, 2017, we had also entered into long-term O&M contracts covering more than 7 GWDC of utility-scale PV solar power systems. We expect to recognize $0.6 billion of revenue during the noncancelable term of these O&M contracts over a weighted-average period of 11.7 years.

As part of our adoption of ASU 2014-09 in the first quarter of 2017, we elected to use the practical expedient under ASC 606-10-65-1(f)(3), pursuant to which we have excluded disclosures of transaction prices allocated to remaining performance obligations and when we expect to recognize such revenue for all periods prior to the date of initial application of ASU 2014-09.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer