AK Steel Holding Corporation is a fully integrated producer of steel. It produces cold-rolled and hot-rolled steel

Question:

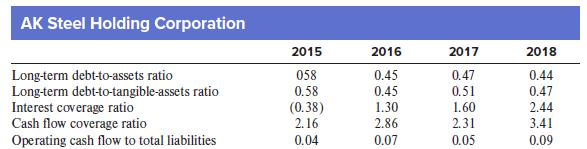

AK Steel Holding Corporation is a fully integrated producer of steel. It produces cold-rolled and hot-rolled steel products as well as specialty stainless and electrical steels that are sold to the domestic automotive, appliance, industrial machinery and equipment, and construction markets. Comparative debt ratios for AK Steel are shown in the following table.

Required:

1. Does AK Steel appear to be able to make its interest payments? How can you tell?

2. Does AK Steel rely heavily on debt to finance asset purchases? Has the company’s reliance on debt changed significantly over the past several years?

3. Does AK Steel have significant amounts of intangible assets? How can you tell?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer