AT&T reported pre-tax income of $24,873 million, $15,139 million, and $12,976 million for the years ended December

Question:

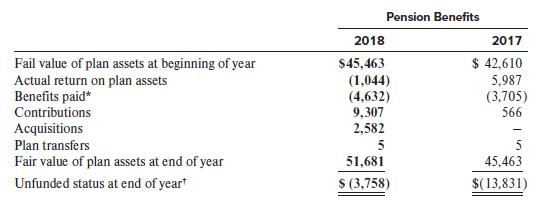

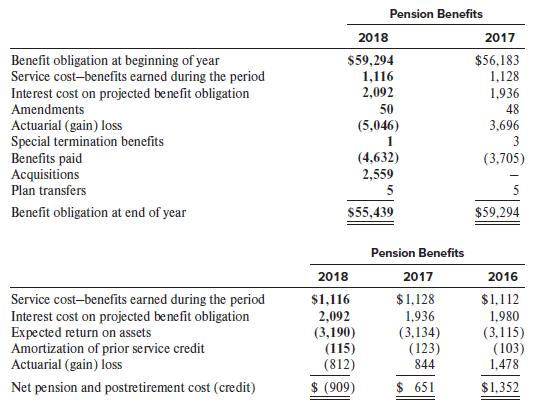

AT&T reported pre-tax income of $24,873 million, $15,139 million, and $12,976 million for the years ended December 31, 2018, 2017, and 2016, respectively. At December 31, 2018, it had 7,281.6 million common shares outstanding and a common share price of $28.54. AT&T Inc. reported the following information for pensions in its December 31, 2018 Form 10-K.

NOTE 14. PENSION AND POSTRETIREMENT BENEFITS

We offer noncontributory pension programs covering the majority of domestic nonmanagement employees in our Communications business. Nonmanagement employees’ pension benefits are generally calculated using one of two formulas: a flat dollar amount applied to years of service according to job classification or a cash balance plan with negotiated annual pension band credits as well as interest credits. Most employees can elect to receive their pension benefits in either a lump sum payment or an annuity.

We acquired Time Warner on June 14, 2018. WarnerMedia and certain of its subsidiaries have both funded and unfunded defined benefit pension plans, the substantial majority of which are noncontributory plans covering domestic employees. WarnerMedia also sponsors unfunded domestic postretirement benefit plans covering certain retirees and their dependents. The plans were closed to new entrants and frozen for new accruals. We have recorded the fair value of the WarnerMedia plans using assumptions and accounting policies consistent with those disclosed by AT&T. Upon acquisition, the excess of projected benefit obligation over the plan assets was recognized as a liability and previously existing deferred actuarial gains and losses and unrecognized service costs or benefits were eliminated.

We recognize gains and losses on pension and postretirement plan assets and obligations immediately in our operating results. These gains and losses are measured annually as of December 31 and accordingly will be recorded during the fourth quarter, unless earlier remeasurements are required.

Required:

1. Refer to the first paragraph of the AT&T note. Explain what is meant by a “cash balance plan.”

2. Explain why pension cost from 2016 to 2018 is so variable.

3. Reconstruct the journal entries associated with recognition and amortization of actuarial gains and losses for 2018.

4. Reconstruct the journal entries associated with recognition and amortization of prior service costs.

5. Compute AT&T short-term and long-term pension risk ratios for 2018.

6. Based on your answer to requirement 5, does AT&T have low, medium, or high pension risk?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer