Blago Wholesale Company began operations on January 1, 20X1, and uses the average cost method in costing

Question:

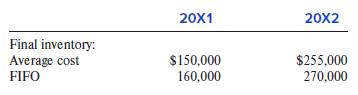

Blago Wholesale Company began operations on January 1, 20X1, and uses the average cost method in costing its inventory. Management is contemplating a change to the FIFO method in 20X2 and is interested in determining how such a change will affect net income. Accordingly, the following information has been developed:

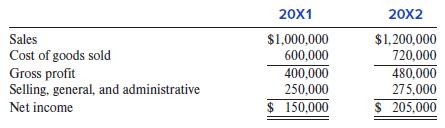

Condensed income statements for Blago Wholesale appear below:

Required:

Based on this information, what would 20X2 net income be after the change to the FIFO method? Ignore any income tax effects of this change in accounting method.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

Question Posted: