Bonny Corp. has a defined benefit pension plan for its employees who have an average remaining service

Question:

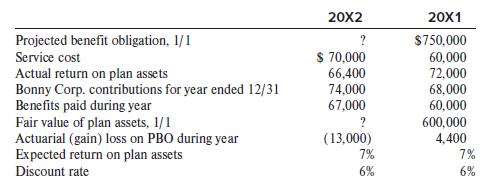

Bonny Corp. has a defined benefit pension plan for its employees who have an average remaining service life of 10 years. The following information is available for 20X1 and 20X2 related to the pension plan:

Bonny Corp. had no beginning balance in its AOCI—net actuarial (gain) loss on January 1, 20X1. The actuarial (gains) losses on PBO arose due to changes in assumptions made by the actuaries regarding salary increases (20X1) and mortality estimates (20X2).

Required:

1. Compute Bonny’s PBO at December 31, 20X1, and December 31, 20X2.

2. Compute the fair value of plan assets at December 31, 20X1, and December 31, 20X2.

3. Compute the funded status of the plan at December 31, 20X1, and December 31, 20X2.

4. Compute the year-end balance in AOCI—net actuarial loss (gain) for Bonny Corp. for 20X1 and 20X2.

5. Compute OCI for the years ended December 31, 20X1, and December 31, 20X2.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer