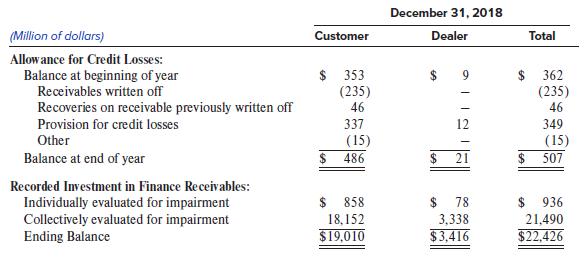

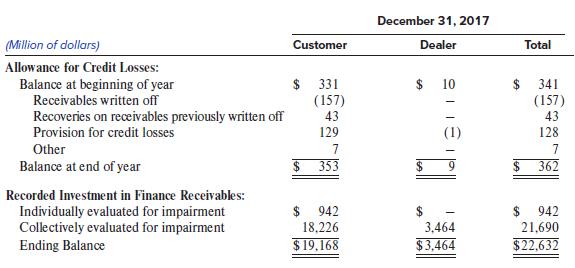

Caterpillar Inc. manufactures and sells earth-moving equipment. Presented below is information on its receivables and allowance for

Question:

Caterpillar Inc. manufactures and sells earth-moving equipment. Presented below is information on its receivables and allowance for credit losses from its 2018 Form 10-K. The “Recorded Investments in Finance Receivables” represent the amortized cost of the receivables before the allowance.

Required:

1. Replicate the analysis shown in Exhibit 9.2, Part C, for Caterpillar for 2018 and 2017. Its revenues for 2018, 2017, and 2016 were $54,722 million, $45,462 million, and $38,537 million, respectively.

2. Based on your analysis in requirement 1, did Caterpillar’s receivable collection experience improve or worsen?

3. Do you think Caterpillar’s provision for credit losses will be higher or lower when it shifts to ASU 2016-13? Explain.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer