Flower Company started doing business on January 1, 20X0. For the year ended December 31, 20X1, it

Question:

Flower Company started doing business on January 1, 20X0. For the year ended December 31, 20X1, it reported $450,000 pre-tax book income on its income statement. Flower is subject to a 21% corporate tax rate for this year and the foreseeable future. Additionally, it has the following issues that affect its tax situation:

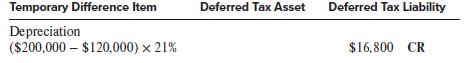

a. At the beginning of 20X1, Flower acquired $600,000 of specialized productive machinery that it depreciates using the straight-line method over five years with no salvage value for accounting purposes. For tax purposes, this specialized equipment is being depreciated $200,000 per year for the first three years of its productive life.

b. During 20X1, the federal government fined Flower $100,000 for violating environmental laws. The fine was paid on November 15, 20X1, and was expensed in determining 20X1’s book income. The fine is not tax deductible.

c. In 20X1, Flower received $40,000 of interest income as a result of its investment in bonds issued by the state of Arizona. The income is not taxable.

d. On January 2, 20X1, Flower leased warehouse space for $2,000 per month for a threeyear period. On January 2, 20X1, as a condition of the lease, Flower paid $30,000 to the lessor to cover the first 15 months of rent. Because Flower leased space in excess of its needs, it immediately (January 2, 20X1) subleased part of the warehouse to a small, local company. The sublease was also for a period of three years and required the tenant to make $800 monthly rent payments to Flower. During 20X1, Flower received $8,800 in monthly rental payments from the sublessee. Pre-tax book income includes an accrual for rent revenue earned but not yet received in cash.

e. During 20X1, Flower’s CEO was killed in an automobile accident. The company had a $200,000 life insurance policy on the CEO and collected the proceeds of the policy during October 20X1.

f. During 20X1, Flower sold a parcel of land held for speculative purposes. The historical cost of the land was $320,000, and it was sold for $680,000. The cash will be collected from the purchaser in 10 monthly installments of $68,000 each. During 20X1, Flower collected five of these $68,000 payments; the remaining payments are assumed to be fully collectible during 20X2.

g. During 20X0, Flower accumulated a $22,000 net operating loss carryforward it can use to offset 20X1 taxable income.

h. At the beginning of 20X1, the balance in the Deferred tax asset account was $4,620, and there was no balance in the Deferred tax liability account.

Required:

1. Beginning with pre-tax accounting income, compute taxable income and taxes due for 20X1. Clearly label all amounts used in arriving at taxable income.

2. Using the following schedule, compute the change in the Deferred tax asset and Deferred tax liability accounts for 20X1. The depreciation temporary difference has been completed as an example.

3. Determine income tax expense for 20X1.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer