Question:

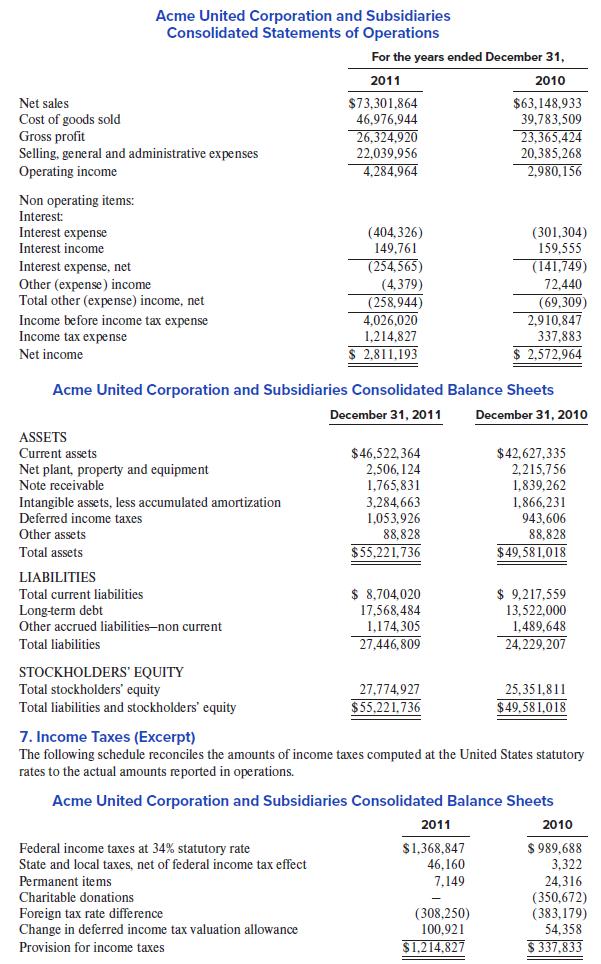

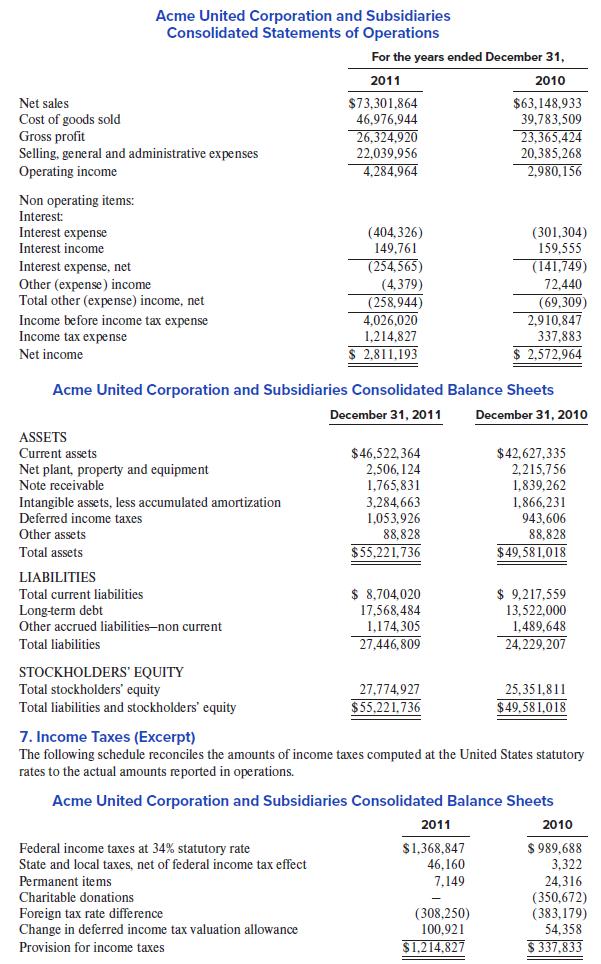

Following are the consolidated statement of operations, balance sheet, and portions of the income tax note from Acme United Corporation’s December 31, 2011, Form 10-K. (For the sake of brevity, the statements have been condensed in ways that are unrelated to the case.)

Required:

Suppose that during 2012, Acme forecasts the following results for 2012:

• Operating income will grow 5% versus 2011.

• Interest expense will be 2.5% of the December 31, 2011, long-term debt balance.

• Interest income will the same as in 2011.

• Other (expense) income will be the same as in 2011.

Also suppose that during 2012, Acme comes to believe a valuation allowance is no longer required and that it will eliminate the valuation allowance entirely when it prepares its 2012 financial statements. Acme expects its effective income tax rate would have been unchanged from 2011 to 2012 had it not been for (a) the effect of the change in the valuation allowance in 2011 on that year’s effective tax rate and (b) the effect of the expected change in the valuation allowance in 2012 on that year’s effective tax rate. What is Acme’s forecasted net income for 2012?

Transcribed Image Text:

Acme United Corporation and Subsidiaries Consolidated Statements of Operations For the years ended Docember 31, 2011 2010 $63,148,933 39,783,509 23.365.424 Net sales $73,301,864 46,976,944 Cost of goods sold Gross profit Selling, general and administrative expenses 26,324,920 22.039.956 20,385,268 Operating income 4.284.964 2,980,156 Non operating items: Interest: Interest expense (404,326) 149,761 (254,565) (301,304) 159,555 (141,749) 72,440 Interest income Interest expense, net Other (expense) income Total other (expense) income, net Income before income tax expense (4,379) (258,944) (69,309) 4,026,020 1,214,827 2,910,847 337,883 $ 2,572,964 Income tax expense Net income $ 2,811,193 Acme United Corporation and Subsidiaries Consolidated Balance Sheets December 31, 2011 December 31, 2010 ASSETS $46,522,364 2,506, 124 1,765,831 Current assets $42,627,335 2,215,756 1,839,262 1,866,231 943,606 88,828 $49,581,018 Net plant, property and equipment Note receivable 3,284,663 1,053,926 88,828 $55,221,736 Intangible assets, less accumulated amortization Deferred income taxes Other assets Total assets LIABILITIES $ 9,217,559 13,522,000 1,489,648 24, 229,207 Total current liabilities $ 8,704,020 Long-term debt 17,568,484 Other accrued liabilities-non current 1,174,305 Total liabilities 27,446,809 STOCKHOLDERS' EQUITY Total stockholders' equity Total liabilities and stockholders' equity 27,774,927 25,351,811 $55,221.736 $49,581,018 7. Income Taxes (Excerpt) The following schedule reconciles the amounts of income taxes computed at the United States statutory rates to the actual amounts reported in operations. Acme United Corporation and Subsidiaries Consolidated Balance Sheets 2011 2010 $ 989,688 3,322 Federal income taxes at 34% statutory rate $1,368,847 46,160 State and local taxes, net of federal income tax effect 24,316 (350,672) (383,179) 54,358 Permanent items 7,149 Charitable donations (308,250) 100,921 Foreign tax rate difference Change in deferred income tax valuation allowance Provision for income taxes $1,214,827 $ 337,833