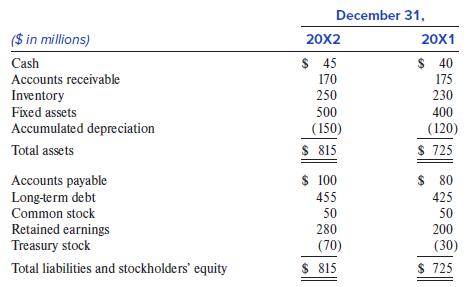

Holmes Company reported the following balance sheets at December 31, 20X2 and 20X1: Its income statement for

Question:

Holmes Company reported the following balance sheets at December 31, 20X2 and 20X1:

Its income statement for 20X2 was as follows:

($ in millions) | |

Sales | $ 1,000 |

Cost of sales | (670) |

Depreciation | (30) |

Other operating expenses | (100) |

Income before taxes | 200 |

Income taxes | (42) |

Net income | $ 158 |

Additional information:

During 20X2, Holmes had the following transactions:

a. Declared and paid a common dividend of $78 million.

b. Purchased additional fixed assets, but did not sell any.

c. Issued $30 million of new debt.

d. Paid interest on all its debt, and included the interest in Other operating expenses.

e. Repurchased common shares, but did not issue any.

Required:

Prepare a cash flow statement for Holmes for 20X2, using the indirect method to present the operating section. Use the worksheet approach described in the appendix to this chapter to construct the cash flow statement.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer