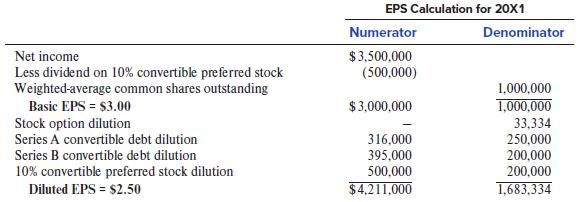

Kadri Corporation (a fictional company) reported basic EPS of $3.00 and diluted EPS of $2.40 for 20X1.

Question:

Kadri Corporation (a fictional company) reported basic EPS of $3.00 and diluted EPS of $2.40 for 20X1. Its EPS calculations follow:

Kadri issued the convertible preferred stock at the beginning of 20X1 and the Series A and Series B convertible debt at par in late 20X0. No stock options were granted or exercised in 20X1.

Required:

1. The convertible preferred stock has a $100 par value per share. How many preferred shares were issued, and what was the common stock conversion rate for each preferred share?

2. The Series B convertible debt pays interest at 10% annually, and Kadri’s marginal income tax rate is 21%. How much Series B debt was outstanding, and what is the common stock conversion rate for each $1,000 face Series B bond?

3. What are the interest rate and common stock conversion rate for the $5 million par of Series A debt?

4. During the year, 50,000 shares were under option, and the average exercise price was $20 per share. What was the average market price of the company’s common stock during 20X1?

5. Explain why Series A debt carries a lower interest rate than Series B debt although both were issued at par on the same day in 20X0.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer