Margaret Magee has served both as an outside director of MX Manufacturing for the past 10 years

Question:

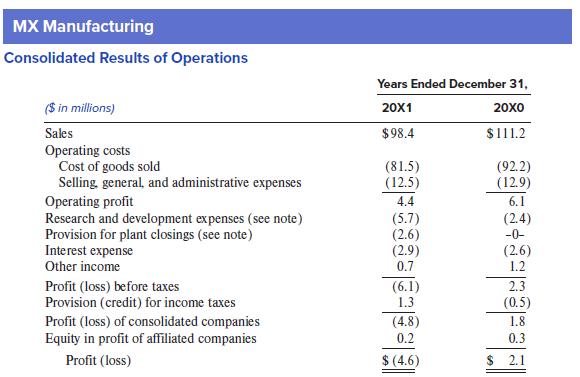

Margaret Magee has served both as an outside director of MX Manufacturing for the past 10 years and as a member of the company’s compensation committee for the past 5 years. Margaret has been reviewing MX’s 20X1 preliminary earnings statement in preparation for the February 20X2 board and compensation committee meetings. She is uneasy about the company’s definition and computation of operating profits for 20X1, particularly because management bonuses at MX are based on achieving specific operating profit goals.

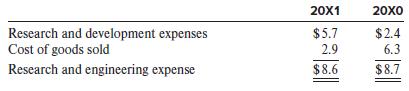

The preliminary financial statements also contained the following notes:

Research and Engineering Expenses. Research and engineering expenses include both amounts charged to Research and development expenses for new product development and charges originally made to Cost of goods sold for ongoing product improvements. The amounts (in millions) for 20X1 and 20X0 were:

Plant Closing Costs. In 20X1, the Company recorded provisions for plant closing and staff consolidation costs totaling $2.62 million. Included in this total are charges related to the probable closing of the Company’s Pennsylvania facility ($1.75 million), the consolidation of the North American operations of the Building Construction Products Division ($0.63 million), and charges to reflect lower estimates of the market value of previously closed U.K. facilities ($0.24 million). These costs include the estimated costs of employee severance benefits, net losses on disposal of land, buildings, machinery and equipment, and other costs incidental to the closing and planned consolidation.

MX Manufacturing is an established, privately held manufacturer that operates in two principal business segments: Building construction products, which involves the design, manufacturing, and marketing of construction and materials-handling machinery, and Engines for various off-highway applications. Before 20X1, the company had experienced 15 years of steadily increasing sales and operating profits.

The company was founded in 1938. Neither the founder nor any members of his family are currently company officers. MX’s common stock is held by a founding family trust (35%), the MX Employee Stock Ownership Plan (ESOP) Trust (50%), a venture capital firm (13%), and current management (2%). Magee also serves as an outside trustee for the MX ESOP Trust.

MX’s senior management participates in an incentive bonus plan that was first adopted 10 years ago. The bonus formula for 20X1 was approved by the compensation committee at its February 20X1 meeting. According to the plan, each senior manager’s 20X1 bonus is to be determined as follows:

Bonus as Percentage | 20X1 Operating Profits |

of 20X1 Salary | ($ in millions) |

0% | Below $4.0 |

100 | At least $4.0 |

200 | At least $6.0 |

300 | At least $8.0 |

The compensation committee can award a lower amount than that indicated by the plan formula if circumstances warrant such action. No bonus reductions have occurred since the plan was adopted.

Required:

1. Why might Magee feel uneasy about MX’s computation of 20X1 operating profits? Should she vote to approve the 100% bonus payment for 20X1 as specified by the plan formula?

2. What changes (if any) would you recommend be made to the bonus formula for next year?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer