Mastrolia Manufacturing produces pacifiers. The company uses absorption costing for external reporting, but management prefers variable costing

Question:

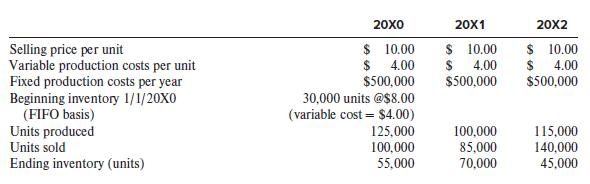

Mastrolia Manufacturing produces pacifiers. The company uses absorption costing for external reporting, but management prefers variable costing for evaluating the profitability of each model. Bonuses, which make up a significant portion of each manager’s annual compensation, are based on attaining certain minimum gross margin percentages. Selected data regarding production and sales of the company’s popular “Little Eric” model follow:

Required:

1. Calculate Mastrolia’s gross profit percentage each year under generally accepted accounting principles. Briefly explain the reasons for any variations in the annual gross profit percentage.

2. Calculate Mastrolia’s gross profit percentage each year under variable costing. Briefly explain the reasons for any variations in the annual gross profit percentage.

3. If you were the manager of the “Little Eric” plant and your annual bonus was based on the plant achieving a gross profit percentage in excess of 15% each year, which method would you prefer and why? (Assume you can significantly influence annual production schedules.)

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer