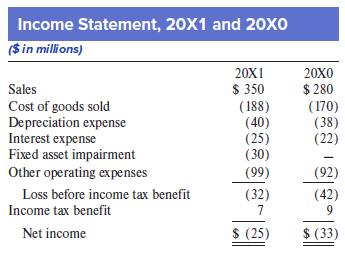

Nagy Corporation reported the following income statement in 20X1, along with a comparable income statement for 20X0,

Question:

Nagy Corporation reported the following income statement in 20X1, along with a comparable income statement for 20X0, its first year of operations:

In its Form 10-K, Nagy also provided a non-GAAP metric, earnings before depreciation and one-time charges, which was a pre-tax earnings measure that excluded depreciation expense and the one-time fixed-asset impairment charge in 20X1. Nagy reported that its earnings before depreciation and one-time charges was $38 million in 20X1 versus a $4 million loss in 20X1.

Required:

Provide the reconciliation (for both 20X1 and 20X0) to the nearest GAAP counterpart that Nagy must include with its non-GAAP metric.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer