National Sweetener Company owns the patent to the artificial sweetener known as Supersweet. Assume that National Sweetener

Question:

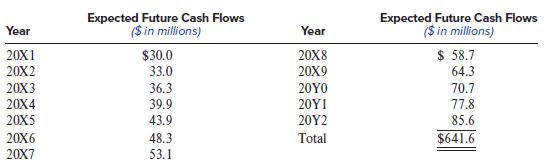

National Sweetener Company owns the patent to the artificial sweetener known as Supersweet. Assume that National Sweetener acquired the patent on January 1, 20X1, at a cost of $300 million; expected the patent to have an economic useful life of 12 years; and has been amortizing the patent on a straight-line basis. Assume that when the patent was acquired, National Sweetener expected that the process would generate future net cash flows of $30 million the first year of its useful life and that the cash flows would increase at a 10% rate each year over the remainder of its useful life. By the year 20Y3, that is, after 12 years, National Sweetener expected that several other artificial sweeteners would be on the market and therefore that it would sell the Supersweet patent then for about $60.0 million.

On December 31, 20X7, when the patent’s book value was $160.0 million ($300.0 − $140.0), National Sweetener learned that one of its competitors had developed a revolutionary new sweetener that could be produced much more economically than Supersweet. National Sweetener expects that the introduction of this product on January 1, 20X8, will substantially reduce the cash flows from its Supersweet patent process.

Consider the following two independent scenarios:

Scenario I: National Sweetener expects that the cash flows from Supersweet over the period 20X8–20Y2 will be only 50% of those originally projected and that the sale of the Supersweet patent will bring only $25 million when sold. When discounted at a rate of 15% (which National Sweetener feels is appropriate), these amounts yield a present value of $129.0 million. National Sweetener estimates that the market value of the Supersweet patent on December 31, 20X7, is $160.0 million.

Scenario II: National Sweetener expects that the cash flows from Supersweet over the period 20X8–20Y2 will be only 25% of those originally projected and that the sale of the Supersweet patent will bring only $25 million when sold. When discounted at a rate of 15%, these amounts yield a present value of $70.7 million. National Sweetener estimates that the market value of the Supersweet patent on December 31, 20X7, is $68.0 million.

Required:

1. Should National Sweetener recognize an impairment of its Supersweet patent in Scenario I? If so, what is the amount of the loss and at what amount should the patent be reported in National Sweetener’s 20X7 ending balance sheet?

2. Repeat requirement 1 for the second scenario.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer