On December 31, 20X1, Pate Corporation acquired 80% of Starmont Corporations common stock for $900,000 cash. Assume

Question:

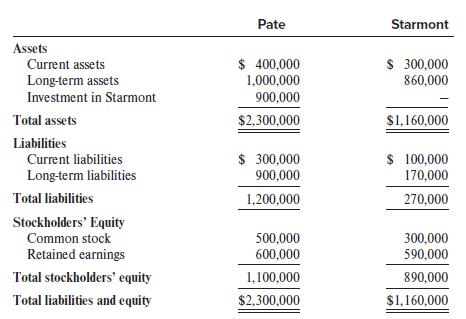

On December 31, 20X1, Pate Corporation acquired 80% of Starmont Corporation’s common stock for $900,000 cash. Assume that the fair values of Starmont’s identifiable assets and liabilities equaled book values on the acquisition date. Following are the December 31, 20X1, separate balance sheets of Pate and Starmont immediately following the acquisition:

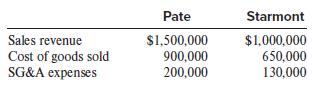

The following are Pate’s and Starmont’s results of operations during 20X2:

Additional Information:

• Included in these totals are intra-entity sales from Pate to Starmont totaling $100,000. Pate applies the same markup on sales to Starmont as to its other customers. Starmont sold all of this inventory to outside customers during 20X2 for $150,000.

• There was no goodwill impairment during 20X2.

• The applicable income tax rate is 21%.

Required:

1. Prepare the December 31, 20X1, consolidated balance sheet under the acquisition method.

2. Prepare the consolidated income statement for the year ended December 31, 20X2.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer