On January 1, 20X1, Chesapeake Corporation issued common stock with a fair value of $810,000 in exchange

Question:

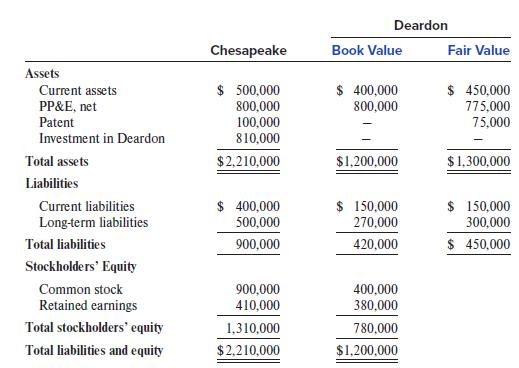

On January 1, 20X1, Chesapeake Corporation issued common stock with a fair value of $810,000 in exchange for 90% of Deardon Corporation’s common stock. Following are the January 1, 20X1, separate balance sheets of Chesapeake and Deardon immediately following the acquisition, plus fair value information for Deardon’s assets and liabilities:

Required:

1. Provide the adjustments and elimination entries needed to prepare the post-acquisition January 1, 20X1, consolidated balance sheet under the acquisition method.

2. Prepare the January 1, 20X1, consolidated balance sheet.

Deardon Chesapeake Book Value Fair Value Assets $ 500,000 800,000 100,000 810,000 $ 400,000 800,000 $ 450,000 775,000 Current assets PP&E, net Patent 75,000 Investment in Deardon Total assets $2,210,000 $1,200,000 $1,300,000 Liabilities $ 400,000 500,000 $ 150,000 270,000 $ 150,000 300,000 Current liabilities Long-term liabilities Total liabilities 900,000 420,000 $ 450,000 Stockholders' Equity Common stock 900,000 410,000 400,000 380,000 Retained earnings Total stockholders' equity 1,310,000 780,000 Total liabilities and equity $2,210,000 $1,200,000

Step by Step Answer:

Requirement 1 The elimination entries that Chesapeake should make in its consolidated worksheet are given below A DR Common Stock 400000 DR Retained E...View the full answer

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

Related Video

This video is about ways to attempt consolidated balance sheet questions. since the unconsolidated financial statements of parent and subsidiary companies are prepared separately, consolidating the balance sheets of both companies is critical and sometimes becomes complex. the tutorial will guide students on to how questions on attempting questions on consolidated financial statements in an easier yet more effective way.

Students also viewed these Business questions

-

On January 1, 2014, Chesapeake Corporation issued common stock with a fair value of $810,000 in exchange for 90% of Deardon Corporations common stock. Following are the January 1, 2014, separate...

-

On January 1, 2017, Chesapeake Corporation issued common stock with a fair value of $810,000 in exchange for 90% of Deardon Corporation's common stock. Following are the January 1, 2017, separate...

-

The following are the balance sheets for Plate and Salad immediately prior to Plate's September 1, 2017, acquisition of Salad: Consider the following cases: Case 1 Plate buys 100% of Salad's common...

-

A Table is in first normal form if there are no repeating groups of data in any column. (True/False)

-

Who is more likely to get a routine medical checkup-employed or unemployed people? To answer this question, a team of physicians and public health professors collected data on a sample of over 2,200...

-

On June 15, 2008, Joanne, for consideration, executed a negotiable promissory note for $10,000, payable to Robert on or before June 15, 2016. Joanne subsequently suffered financial reverses. In...

-

White Mountain Corporation (WMC) sells computer components. It is a publicly traded corporation. William serves as WMCs Chief Executive Officer (CEO). William owns 15 percent of WMCs outstanding...

-

All-Star Automotive Company experienced the following accounting events during 2016: 1. Performed services for $25,000 cash. 2. Purchased land for $6,000 cash. 3. Hired an accountant to keep the...

-

1. In figure, two identical particles each of mass m are tied together with an inextensible string. This is pulled at its centre with a constant force F. If the whole system lies on a smooth...

-

After completing a course in database management, you are asked to develop a preliminary ERD for a symphony orchestra. You discover the entity types that should be included as shown in Table 2-3....

-

Figa Company acquired a bond issued by Stewart Company on January 1, 20X1. The $100,000 bond had a coupon rate of 4%, with payments made semiannually. The bond was scheduled to mature on December 31,...

-

Figa Company acquired a bond issued by Stewart Company on January 1, 20X1. The $100,000 bond had a coupon rate of 4%, with payments made semiannually. The bond was scheduled to mature on December 31,...

-

Agilent Technologies Inc., a diversified technology company, sells extended warranties for the products and services provided to customers, deferring the revenue until future recognition. The...

-

Find the state vector via the formal-solution approach. \(\dot{\mathbf{x}}=\left[\begin{array}{ccc}1 & 0 & 0 \\ 0 & 1 & 0 \\ -1 & -2 & -3\end{array} ight] \mathbf{x}+\left[\begin{array}{l}0 \\ 0 \\...

-

The Bode plot of a second-order system indicates that the approximate lowfrequency magnitude is \(2.28 \mathrm{~dB}\), the approximate high-frequency \((\omega=1000 \mathrm{r} / \mathrm{s})\)...

-

The governing equation for an \(\mathrm{RC}\) circuit driven by an applied voltage \(v(t)\) is derived as \[R C \dot{V}+V=v(t), V(0)=V_{0}\] where: \(V\) is the voltage across the capacitor \(V_{0}\)...

-

A first-order dynamic system is modeled as \[\frac{1}{2} \dot{w}+5 w=g(t), w(0)=\frac{2}{3}\] If the input \(g(t)\) is a ramp function with a slope of \(\frac{5}{2}\), find the steady-state response...

-

A first-order dynamic system is modeled as \[\dot{y}+3 y=f(t), y(0)=1\] Assuming the input \(f(t)\) is a step function with magnitude 0.8 , find \(y_{s s}\).

-

You want to have $50,000 in your savings account 12 years from now, and you're prepared to make equal annual deposits into the account at the end of each year. If the account pays 6.2 percent...

-

Rosalie owns 50% of the outstanding stock of Salmon Corporation. In a qualifying stock redemption, Salmon distributes $80,000 to Rosalie in exchange for one-half of her shares, which have a basis of...

-

a. 1. What is the balance in receivables at February 26, 2011 and February 27, 2010? 2. What is the gross receivables at February 26, 2011 and February 27, 2010? b. Merchandise Inventories Our...

-

a. Entities are required to use a fair value hierarchy. Why? b. There are three levels of inputs that may be used to measure fair value. What are the three levels and describe each. c. For Merck &...

-

Melcher Company reported earnings per share in 2011 and 2010 of $ 2.00 and $ 1.60, respectively. In 2012, there was a 2- for- 1 stock split, and the earnings per share for 2012 were reported to be $...

-

Suppose that a lumberyard has a supply of 10-ft boards, which are cut into 3-ft, 4-ft, and 5-ft boards according to customer demand. The 10-ft boards can be cut into several sensible patterns. each...

-

Explain how the use of bound parameters can help defend against web application exploitation.

-

Need summary of this article Why can't my new employees write? I heard this question several times on my recent vacation. I go on vacation to get away from these sorts of questions, but vacation was...

Study smarter with the SolutionInn App