On January 1, 20X1, Overseas Leasing Inc. (the lessor) purchased five used oil tankers from Seven Seas

Question:

On January 1, 20X1, Overseas Leasing Inc. (the lessor) purchased five used oil tankers from Seven Seas Shipping Company at a price of $99,817,750. Overseas immediately leased the oil tankers to Pacific Ocean Oil Company (the lessee) on the same date. The lease calls for five annual payments of $25,000,000 to be made at each year-end. The tankers have a remaining useful life of five years with no salvage value, and the lease does not require the lessee to guarantee any residual value for the tankers. The lessor has structured the lease to earn a rate of return of 8.0%.

Required:

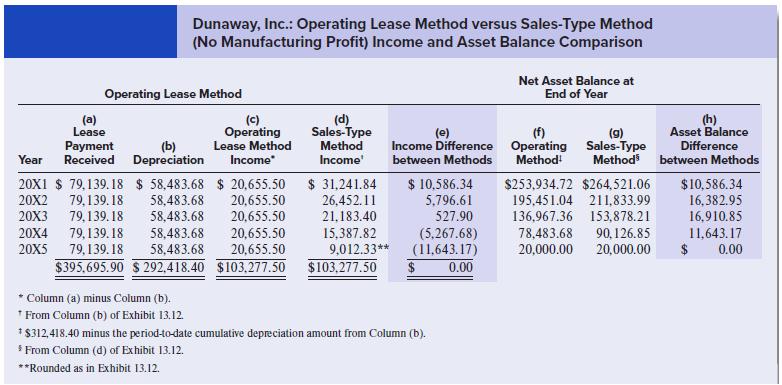

Prepare a schedule similar to Exhibit 13.13. This schedule should contain the year-to-year income statement and balance sheet differences that would arise depending on whether this lease is accounted for as a sales-type lease or as an operating lease.

Exhibit 13.13.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer