On July 1, 20X1, Pushway Corporation issued 100,000 shares of common stock in exchange for all of

Question:

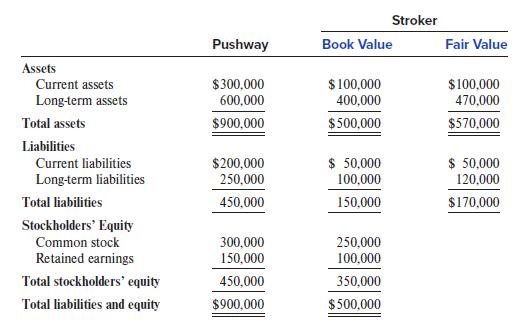

On July 1, 20X1, Pushway Corporation issued 100,000 shares of common stock in exchange for all of Stroker Company’s common stock. The Pushway stock issued had a market value of $500,000 on the date of the exchange. Following are the July 1, 20X1, pre-acquisition balance sheets of Pushway and Stroker, plus fair value information for Stroker’s assets and liabilities:

Required:

1. Provide the journal entry Pushway recorded for the acquisition of Stroker, assuming Pushway used the acquisition method.

2. What amount will be shown on the July 1, 20X1, consolidated balance sheet for the following:

a. Total assets

b. Total liabilities

c. Total equity

3. Now assume this transaction had been completed prior to the elimination of poolings of interest, and that the pooling method had been used to record the acquisition. Redo requirements 1 and 2.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer