Randall Manufacturing has requested a $2 million, four-year term loan from Farmers State Bank. It will use

Question:

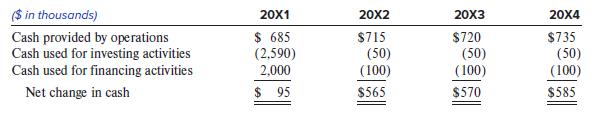

Randall Manufacturing has requested a $2 million, four-year term loan from Farmers State Bank. It will use the money to expand its warehouse and to upgrade its assembly line. Randall supplied the following cash flow forecasts as part of the loan application.

The forecasts assume that the loan is granted at the beginning of 20X1 and that $2.59 million will be spent that year on the expansion and upgrade. Randall plans to spend $50,000 each year to replace worn-out manufacturing equipment and $100,000 each year for dividends.

Required:

1. As the bank’s chief loan officer, what is your opinion about the degree of credit risk associated with this $2 million loan?

2. How can Randall Manufacturing lower its credit risk?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer