Rite Aid Corporation operates retail drugstores in the United States. It is one of the countrys largest

Question:

Rite Aid Corporation operates retail drugstores in the United States. It is one of the country’s largest retail drugstore chains with 3,333 stores in operation as of March 3, 20X3. The company’s drugstores’ primary business is pharmacy services. The company also sells a full selection of health and beauty aids and personal care products, seasonal merchandise, and a large private brand product line.

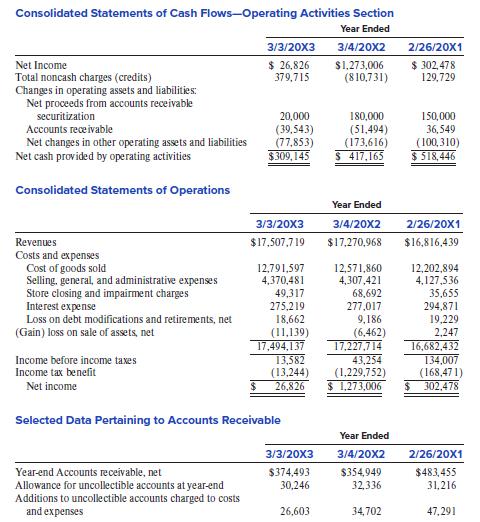

The following condensed information was extracted from Rite Aid’s Form 10-K for the fiscal year that ended March 3, 20X3 (all dollars in thousands).

Accounts Receivable

The Company maintains an allowance for doubtful accounts receivable based upon the expected collectibility of accounts receivable. The allowance for uncollectible accounts at March 3, 20X3, and March 4, 20X2, was $30,246 and $32,336, respectively. The Company’s accounts receivable are due primarily from third-party payors (e.g., pharmacy benefit management companies, insurance companies, or governmental agencies) and are recorded net of any allowances provided for under the respective plans. Since payments due from third-party payors are sensitive to payment criteria changes and legislative actions, the allowance is reviewed continually, and adjusted for accounts deemed uncollectible by management. The Company maintains securitization agreements with several multiseller asset-backed commercial paper vehicles (“CPVs”). Under the terms of the securitization agreements, the Company sells substantially all of its eligible third-party pharmaceutical receivables to a bankruptcy remote Special Purpose Entity (SPE) and retains servicing responsibility. The assets of the SPE are not available to satisfy the creditors of any other person, including any of the Company’s affiliates. These agreements provide for the Company to sell, and for the SPE to purchase these receivables. The SPE then transfers an interest in these receivables to various CPVs. Transferred outstanding receivables cannot exceed $400,000. The amount of transferred receivables outstanding at any one time is dependent upon a formula that takes into account such factors as default history, obligor concentrations, and potential dilution (“Securitization Formula”). Adjustments to this amount can occur on a weekly basis. At March 3, 20X3, and March 4, 20X2, the total of outstanding receivables that have been transferred to the CPVs were $350,000 and $330,000, respectively. The Company has determined that the transactions meet the criteria for sales treatment in accordance with (pre-Codification) SFAS No. 140 “Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities.

Required:

1. Calculate cash collected from customers during fiscal 20X3.

2. Had Rite Aid not securitized receivables during 20X3, 20X2, and 20X1, what would its operating cash flows have been in each of these years? Do you believe that Rite Aid’s operating cash flows were materially affected by its receivables securitization practices?

3. Calculate pre-tax operating income for 20X3, 20X2, and 20X1, and compare it to operating cash flows as originally reported and to operating cash flows assuming that Rite Aid did not securitize receivables. Compare both results and comment on the impact of Rite Aid’s practice of securitizing receivables. (Hint: When calculating pre-tax operating income, include only items that relate to core business operations.)

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer