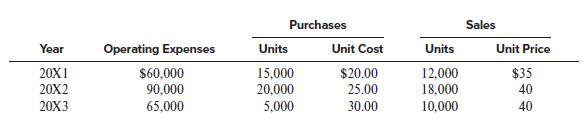

Sirotka Retail Company began doing business in 20X1. The following information pertains to its first three years

Question:

Sirotka Retail Company began doing business in 20X1. The following information pertains to its first three years of operation:

Assume the following:

• The income tax rate is 21%.

• Purchase and sale prices change only at the beginning of the year.

• Sirotka uses the LIFO cost flow assumption.

• Operating expenses are primarily selling and administrative expenses.

Required:

1. Compute cost of goods sold and the cost of ending inventory for each of the three years. (Identify the number of units and the cost per unit for each LIFO layer in the ending inventory.)

2. Prepare income statements for each of the three years.

3. Compute the LIFO reserve at the end of 20X1, 20X2, and 20X3.

4. Compute the effect of LIFO liquidation on the net income of the company for the years 20X2 and 20X3.

5. Compute the inventory turnover ratio for the years 20X2 and 20X3. Do not make adjustments for any potential biases in LIFO accounting. Comment on the direction of the bias (that is, understated/overstated) in the inventory turnover ratio under LIFO. Is the ratio in one year more biased than in the other? Explain.

6. How can the physical turnover of inventory (that is, true inventory turnover) best be approximated using all of the information available in a LIFO financial statement? Illustrate your approach by recomputing Sirotka’s inventory turnover ratios for 20X2 and 20X3.

7. Compute the gross margin percentages for the years 20X2 and 20X3. Explain whether the difference in the gross margin percentages between 20X2 and 20X3 reflect the change in Sirotka’s economic condition from 20X2 and 20X3.

8. Provide an estimate of the FIFO cost of goods sold for the years 20X1, 20X2, and 20X3 using the information available in the financial statements.

9. Based on your answers to requirements 1 and 8, estimate Sirotka’s tax savings for 20X1, 20X2, and 20X3.

10. Assuming a discount rate of 10%, compute the January 1, 20X1, present value of the tax savings over the period 20X1–20X3 (that is, discount the 20X1 tax savings one period, and so on).

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer