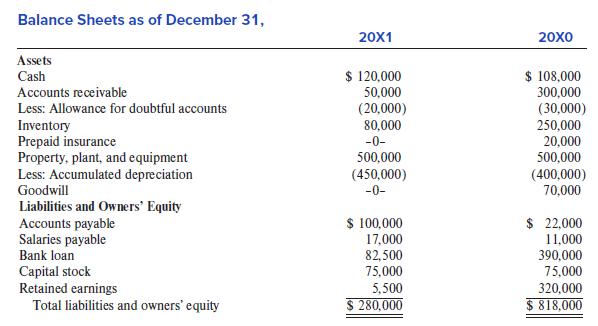

The balance sheets of Global Trading Company follow: Additional Information: The company reported a net loss

Question:

The balance sheets of Global Trading Company follow:

Additional Information:

• The company reported a net loss of $279,500 during 20X1.

• There are no income taxes.

• Goodwill as of December 31, 20X0, was part of an acquisition made during 20X0.

• The company’s bank provides a working capital loan to a maximum of 75% of net accounts receivable and inventory.

Required:

1. Prepare a statement of cash flows using the indirect method for the year ended December 31, 20X1.

2. On the basis of available information, assess the financial performance of the company during 20X1. In answering this part, consider both the net income and cash flows of the company. Also evaluate the future prospects of the company.

3. Assuming that the bad debt expense during 20X1 was $55,000, calculate the amount of bad debts written off during the year. Further assume that the company collected $1,250,000 cash from its customers during 20X1, and then compute the sales revenue for the year. You may assume that all sales are credit sales.

4. In answering this part, assume that Global uses the first-in, first-out (FIFO) inventory method. On December 31, 20X1, the company purchased $35,000 worth of inventory on credit from a supplier. The transaction was inadvertently not recorded and the inventory not included in the December 31, 20X1, physical inventory count. Discuss the effect of this omission on Global Trading Company’s financial statements.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer