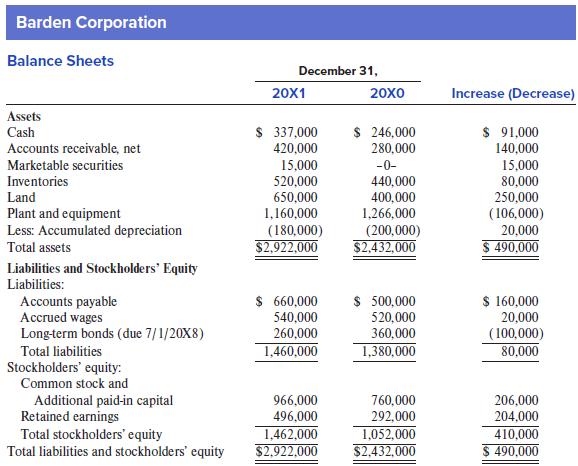

The Barden Corporations comparative balance sheets for 20X1 and 20X0 are presented below. Income Statement for the

Question:

The Barden Corporation’s comparative balance sheets for 20X1 and 20X0 are presented below.

Barden Corporation | |

Income Statement for the Year Ended December 31, 20X1 | |

Sales | $ 1,600,000 |

Gain on sale of marketable securities | 2,000 |

Gain on extinguishment of debt | 44,000 |

Total revenue and gains | 1,646,000 |

Expenses: | 720,000 |

Cost of goods sold | 386,000 |

Personnel costs | 40,000 |

Depreciation | 8,000 |

Loss on sale of equipment | 32,000 |

Interest | 16,000 |

Miscellaneous | 1,202,000 |

Total expenses | 444,000 |

Income before income taxes | 200,000 |

Income tax expense | $ 244,000 |

Net income | $ 1,600,000 |

Additional Information:

a. On January 11, 20X1, Barden purchased land for $170,000 cash.

b. On January 23, 20X1, Barden extinguished long-term bonds with a face value of $100,000.

c. On February 8, 20X1, Barden issued 8,400 shares of common stock for cash. The stock was issued at $15 per share.

d. Barden purchased marketable securities for $30,000 on March 15, 20X1; one-half of the securities were later sold on December 3, 20X1.

e. On June 9, 20X1, Barden issued 7,600 shares of common stock for land. The common stock and land had current market values of $80,000 at the time of the transaction.

f. On July 1, 20X1, Barden declared and paid a $40,000 cash dividend.

g. On October 18, 20X1, Barden sold equipment costing $106,000, with a book value of $46,000, for $38,000 cash.

Required:

Prepare a cash flow statement using the indirect method for operating activities.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer