The Compensation Committee chose consolidated EBITDA [earnings before interest, taxes, depreciation, and amortization] and revenue as the

Question:

The Compensation Committee chose consolidated EBITDA [earnings before interest, taxes, depreciation, and amortization] and revenue as the performance metrics for fiscal 2012, weighted at 80% and 20%, respectively. Consolidated EBITDA is defined the same way as it is defined in our secured credit facilities. The Compensation Committee assigned three levels of performance for consolidated EBITDA and for Revenue: threshold, target, and maximum.

Source: Krispy Kreme Doughnuts, Inc. 2012 Proxy, edited for brevity. Krispy Kreme was a public company before being acquired by JAB Holding Company in 2016.

The disclosure further indicates that eligible recipients would receive 70%, 100%, or 140% of the portion of the target bonus for performance attributable to each performance metric for performance at the threshold, target, and maximum levels, respectively. The bonus for performance that falls between two of those levels would be prorated.

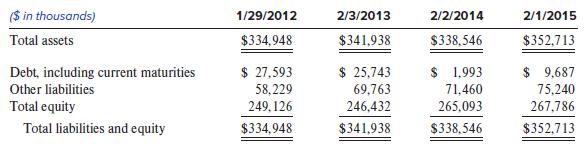

The following table provides summary balance sheet information for several years.

Required:

1. One way Krispy Kreme executives could achieve the revenue target is to open new stores as quickly as possible. Explain why this might alarm shareholders.

2. Why might it be important for the bonus plan to use the same EBITDA definition used in Krispy Kreme’s “secured credit facilities” (loan agreements)?

3. Describe how Krispy Kreme’s executive bonus plan could encourage accounting abuses.

4. Beginning in fiscal 2014 (the year ended February 1, 2015), Krispy Kreme began using pretax income instead of EBITDA as a performance metric in its compensation plan. What information in the company’s balance sheets suggests its management may have been responding to changing financial incentives when the performance metric changed?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer