The following data pertain to Tyne Companys investments in marketable equity securities. (Assume that all securities were

Question:

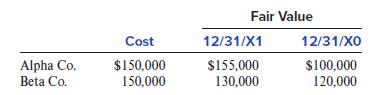

The following data pertain to Tyne Company’s investments in marketable equity securities. (Assume that all securities were held throughout 20X0 and 20X1.)

Required:

1. What amount should Tyne report as unrealized holding gain (loss) in its 20X1 income statement?

2. If Tyne were to sell its Alpha Co. investment in 20X2 for $157,000, what amount of gain or loss would it report on the sale in that year?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

Question Posted: