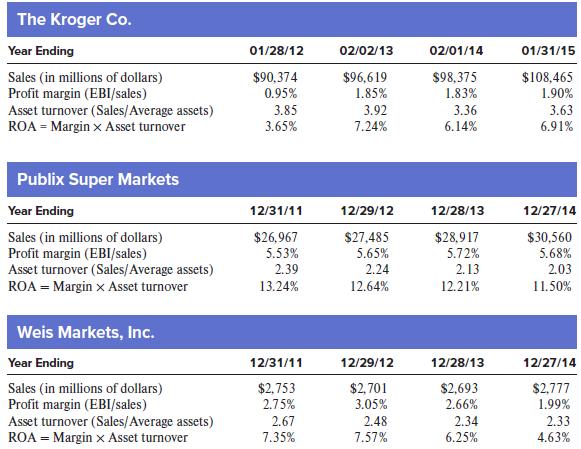

The following table presents ROA calculations for The Kroger Co., Publix Super Markets, and Weis Markets, Inc.

Question:

The following table presents ROA calculations for The Kroger Co., Publix Super Markets, and Weis Markets, Inc. for several years prior to those examined in the chapter.

Required:

1. Which company has shown the strongest sales growth over the past three years?

2. Which company was the most profitable in its most recent fiscal year? What was the source of that superior profitability—a profit margin advantage or better turnover?

Transcribed Image Text:

The Kroger Co. Year Ending 01/28/12 02/02/13 02/01/14 01/31/15 Sales (in millions of dollars) Profit margin (EBI/sales) Asset turnover (Sales/Average assets) ROA = Margin x Asset turnover $90,374 $96,619 $98,375 $108,465 1.90% 0.95% 1.85% 1.83% 3.85 3.92 3.36 3.63 6.91% 3.65% 7.24% 6.14% Publix Super Markets Year Ending 12/31/11 12/29/12 12/28/13 12/27/14 Sales (in millions of dollars) Profit margin (EBI/sales) Asset turnover (Sales/Average assets) ROA = Margin x Asset turnover $26,967 $27,485 $28,917 $30,560 5.68% 5.53% 5.65% 5.72% 2.39 2.24 2.13 2.03 13.24% 12.64% 12.21% 11.50% Weis Markets, Inc. Year Ending 12/31/11 12/29/12 12/28/13 12/27/14 $2, 701 3.05% Sales (in millions of dollars) Profit margin (EBI/sales) Asset turnover (Sales/Average assets) ROA = Margin x Asset turnover $2,753 $2,693 $2,777 2.75% 2.66% 1.99% 2.67 2.48 2.34 2.33 7.35% 7.57% 6.25% 4.63%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

Requirement 1 Following are sales growth data for the three companies All dollar amounts are i...View the full answer

Answered By

Shadrack Mulunga

I am a Biochemistry by profession. However, I have explored different fields of study. My quest to explore new fields has helped me gain new knowledge and skills in Business, clinical psychology, sociology, organizational behavior and general management, and Project Management. I count my expertise in Project management, in particular, creation of Work Break Down Structure (WBS) and use of Microsoft Project software as one of my greatest achievement in Freelancing industry. I have helped thousands of BSC and MSC students to complete their projects on time and cost-effectively using the MS Project tool. Generally, I find happiness in translating my knowledge and expertise to success of my clients. So far, i have helped thousands of students to not only complete their projects in time but also receive high grades in their respective courses. Quality and timely delivery are the two key aspects that define my work. All those who hired my services always come back for my service. If you hire my services today, you will surely return for more. Try me today!

5.00+

154+ Reviews

289+ Question Solved

Related Book For

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

Question Posted:

Students also viewed these Business questions

-

The following table presents ROA calculations for three companies in the retail grocery industry using earnings before interest (EBI) and balance sheet data for each company. The Kroger Company...

-

Superior Leather Products, Inc., has two divisions: Travel Bags Division and Leather Accessories Division. The following table presents their performance for the most recent year. Required: a....

-

The Company classifies its investments in both fixed income securities and publicly traded equity securities as available- for- sale investments. Fixed income securities primarily consist of U. S....

-

Assuming that the Fed judges inflation to be the most significant problem in the economy and that it wishes to employ all of its policy instruments except interest on reserves, what should the Fed do...

-

Suppose someone has presented the following regression results for your consideration: t = 2.6911 - 0.4795Xi where Y = coffee consumption in the United States (cups per person per day) X = retail...

-

Is there a classical limit of the measure of quantum chaos described here? How would you compare the classical and quantum chaos descriptions?

-

Adil & Bazhenskiy uses sales, cash receipts and general journals in its accounting system. The firm also maintains an accounts receivable subsidiary ledger, which contained the following accounts on...

-

Incredibly Fast Transportation (IFT) began 2014 with accounts receivable, inventory, and prepaid expenses totaling $ 56,000. At the end of the year, IFT had a total of $ 59,000 for these current...

-

1. Let p and q be two positive numbers such that p + q = 2 and p + q = 272. Then p and q are roots of the equation: (a) x-2x+8=0 2. lim x 0 (sint)dt (b) x-2x+136=0 (c) x-2x+16=0 (d) x-2x+2=0 0

-

A multimode fiber with a 50-m core diameter is designed to limit the intermodal dispersion to 10 ns/km. What is the numerical aperture of this fiber? What is the limiting bit rate for transmission...

-

The following information is from the 20X1 annual report of Weber Corporation, a company that supplies manufactured parts to the household appliance industry. Average total assets $24,500,000 Average...

-

McDonalds Corporation franchises and operates more than 36,000 fast-service restaurants around the world. Buffalo Wild Wings franchises and operates more than 1,000 restaurants in North America....

-

The following data represent the number of speeding tickets issued to individuals in the past year and the gender of the individuals. Determine the following probabilities based on the results of the...

-

Lottery A offers a 70 % chance of winning $45 and a 30 % chance of losing $100. Lottery B offers a 60 % chance of winning $55 and a 40 % chance of losing $85. Lottery C offers an 80 % chance of...

-

What is the capital asset pricing model (CAPM)? What are the assumptions of this model? What does it tell us?

-

When we use a lagged dependent variable in our regression, R 2 is generally much higher than when such a variable is not included. Can you think of any reasons why?

-

Briefly explain what the dominance principle is and how it can be used in risk and- return analysis.

-

What is the maximin criterion? When is it best to use the maximin criterion?

-

On January 1, 2013, Randy Incorporated purchased $600,000 of 20-year, 10% bonds when the market rate of interest was 8%. Interest is to be paid on June 30 and December 31 of each year. 1. Prepare the...

-

Privitera and Freeman (2012) constructed a scale to measure or estimate the daily fat intake of participants; the scale was called the estimated daily intake scale for fat (EDIS-F). To validate the...

-

The following information is available for Fess Company: Credit sales during 2017.............................................................$150,000 Allowance for doubtful accounts at December 31,...

-

Lake Company sold some machinery to View Company on January 1, 2017, for which the cash selling price was $758,200. View entered into an installment sales contract with Lake at a 10% interest rate....

-

Weaver, Inc., received a $60,000, six-month, 12% interest-bearing note from a customer. The note was discounted (sold) the same day to Third National Bank at 15%. Required: Compute the amount of cash...

-

To set up an optimal portfolio problem considering transactions costs, we need to adjust the expected return of stocks and calculate the transactions-cost-adjusted expected return. Suppose that a $1...

-

How to calculate the average precision (AP) for each adopted query and the mean average precision (MAP), based on both arithmetic and geometric means, must be calculated in terms of interpolated...

-

Using the relative contribution of the B to the overall expected portfolio return, show whether index leverage or single-stock leverage results in better leverage for a portfolio manager who is good...

Study smarter with the SolutionInn App