The following table provides ROA and ROCE for Best Buy, a retailer of consumer electronics. The adjusted

Question:

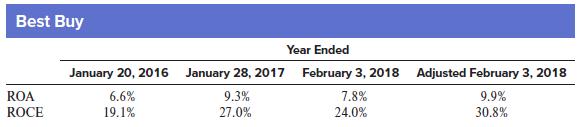

The following table provides ROA and ROCE for Best Buy, a retailer of consumer electronics.

The adjusted February 3, 2018, amounts exclude the one-time income statement effect of the Tax Cuts and Jobs Act.

Required:

1. In analyzing Best Buy, is it most appropriate to use the actual results for the year ended February 3, 2018, or the adjusted results?

2. How did Best Buy’s performance change over the period shown?

3. What is the most likely reason the change in ROCE was so much greater than the change in ROA?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

Question Posted: