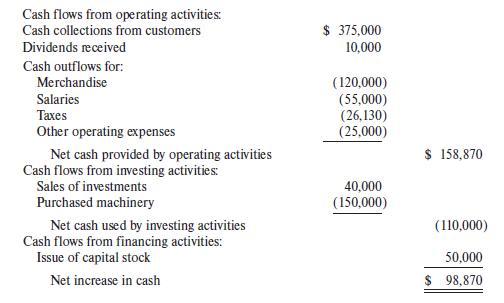

The statement of cash flows for the year ended December 31, 20X1, and other data for Bradley

Question:

The statement of cash flows for the year ended December 31, 20X1, and other data for Bradley Corporation are shown below:

Additional data:

a. Bradley’s Dividends receivable account decreased by $2,000 during the year.

b. The Machinery account, net of accumulated depreciation, increased by $100,000 during the year. The only transaction involving Machinery, other than depreciation and the purchase shown in the statement above, was the write-off on May 15, 20X1, of obsolete machinery that had a book value of $8,000.

c. Accounts receivable increased by $40,000 during 20X1. The Allowance account increased by $4,000. There were no write-offs of uncollectible accounts.

d. Salaries payable at the beginning of the year were $6,000; at the end of the year, $10,000.

e. Inventories decreased $12,000 during 20X1.

f. Taxes payable increased $6,000 during the year.

g. The investments that were sold had a book value of $40,000.

Required:

On the basis of the above information, prepare Bradley Corporation’s single-step income statement for the year ended December 31, 20X1.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer