United Company has two foreign subsidiaries, Cancorp and Britcorp. Cancorp operates in Canada and Britcorp operates in

Question:

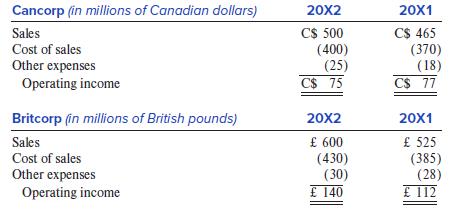

United Company has two foreign subsidiaries, Cancorp and Britcorp. Cancorp operates in Canada and Britcorp operates in the United Kingdom. Both companies are 100% owned by United Company and their financial statements are translated into U.S. dollars using the current rate method. United has no other foreign subsidiaries. The following are local currency partial income statements for the two foreign subsidiaries. All income statement amounts occurred evenly through the year.

During 20X2 the Canadian dollar appreciated against the U.S. dollar while the British pound fell in value against the dollar. Your assistant neglected to provide you actual exchange rates, but instead gave the following information on the percentage change in each of the exchange rates against the U.S. dollar:

Canadian Dollar: | |

Year-end exchange rate 20X2/Year-end exchange rate 20X1 | 110% |

Average exchange rate 20X2/Average exchange rate 20X1 | 108% |

British Pound: | |

Year-end exchange rate 20X2/Year-end exchange rate 20X1 | 85% |

Average exchange rate 20X2/Average exchange rate 20X1 | 90% |

In other words, the December 31, 20X2, value of one Canadian dollar as stated in U.S. dollars divided by the corresponding value at December 31, 20X1, was 1.10, indicating a 10% increase in the value of the Canadian dollar over the course of the year.

Required:

1. What sales growth percentages (20X2 v. 20X1) will be reported for Cancorp, based on both its Canadian dollar income statements and its U.S. dollar income statements after translation?

2. For 20X2, what operating margin percentages (operating income/sales) will be reported for Britcorp, in both its British pound income statement and its U.S. dollar income statement after translation?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer