Assume that on December 31, 2017, The Coca-Cola Company borrows money from a consortium of banks by

Question:

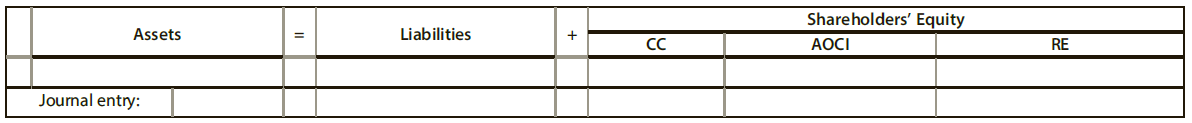

a. Using the effective interest method, complete the template below to show the financial statement effects of (1) the December 31, 2017, issue; (2) the December 31, 2018, interest payment and interest expense accrual; and (3) the December 31, 2019, interest payment and interest expense accrual.

b. Assume that events involving foreign operations have increased the risk of The Coca-Cola Company to the point where creditors expect a 5% return on the note as of December 31, 2019. What amounts would Coca-Cola report for long-term debt (1) on the face of its December 31, 2019, balance sheet and (2) in the notes to the financial statements?

c. In addition to the information in Requirement b, assume that The Coca-Cola Company has chosen the fair value option for the reporting of this note. What amounts would Coca-Cola report for long-term debt (1) on the face of its December 31, 2019, balance sheet and (2) on the income statement with respect to the note's fair value change?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw